After listing on the Australian Stock Exchange in January, VHM (ASX: VHM) said it will make a final investment decision in the second half of this year on its flagship, 100%-owned rare earth and mineral sands Goschen project in Australia.

The initial public offering followed a conditional memorandum of understanding with a subsidiary of China’s Shenghe Resources Holding Company for a three-year take or pay offtake agreement for 60% of production from Goschen. Shenghe, listed on the Shanghai Stock Exchange, is a leading processor and producer of rare earth materials.

Goschen, located about 300 km northwest of Melbourne in the state of Victoria, is “one of the world’s largest rare-earth deposits (413,107 tonnes of contained TREO), with an accompanying world-class mineral sands resource,” the company notes in a recent corporate presentation. About 87% of Goschen’s rare earth minerals’ basket value, it says, is expected to be derived from dysprosium (17%), neodymium (46%), praseodymium (12%) and terbium (12%) oxides.

Goschen ore consists of weathered sands enriched in the REE-bearing minerals monazite and xenotime, zircon, rutile and ilmenite.

The project’s JORC-compliant proven and probable reserves stand at 198.7 million tonnes grading 3.7% THM [total heavy mineral], 21.7% zircon, 9.7% rutile, 8.2% leucoxene, 25.7% ilmenite, 3.5% monazite, and 0.6% xenotime.

Australia-based analysts Tom Prendiville and Reg Spencer of Canaccord Genuity, estimated in a research report that they expect rare earths will make up about 70% of Goschen’s life-of-mine earnings before interest, taxes, depreciation and amortization (EBITDA), with the remainder comprising mineral sands, and of those, mainly zircon.

They also noted that Goschen gained “national recognition from the Australian government when it was granted major project status in 2021, as a potential producer of critical minerals.”

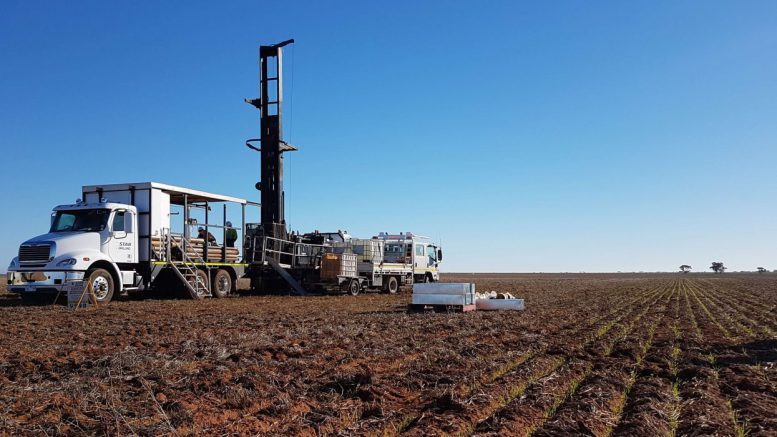

A definitive feasibility study completed in the first quarter of 2022 outlined a 5 million tonne per-year open-pit mine operation with a mine life of 20 years and assessed initial production of a rare earth mineral concentrate (REMC) product and a zircon-titanium heavy mineral concentrate product.

The study also examined a staged development of further downstream products (phase 1A) including a mixed rare earth carbonate (MREC). The company has commissioned an engineering study for a rare earth hydromet circuit that will refine the REMC to MREC product.

“Phase 1A assumes the REMC is upgraded to a higher-value mixed rare earth carbonate (MREC) via a hydrometallurgical circuit likely ~ 18 months after first production (i.e. 2027) to produce 9-11ktpa MREC (including 6-7kt TREO and 1.1.5ktpa NdPr),” Canaccord’s analysts wrote. “We model development capex of ~A$640 million or +15% above study estimates to account for industry inflation.”

An updated study is expected in the first half of this year. If the company decides to build the mine, it is targeting first production in the first half of 2025.

The analysts note that the mineralization in the monazite-xenotime bearing heavy mineral sands deposit “occurs in the form of fully liberated (i.e. free dig unconsolidated) sands near surface (~30 metres in depth), which differs to other deposits in Australia, which are carbonatites (i.e. hardrock),” they wrote.

“As a result of the soft-rock composition, the deposit should allow for relatively low-cost extraction and processing without crushing or grinding.”

Be the first to comment on "Australia’s VHM nears investment decision on Goschen rare earths project"