Arizona Metals (TSX: AMC; US-OTC: AZMCF) says its latest drill results show the potential to expand the old Kay Mine copper-gold deposit in Arizona, which hasn’t been mined in almost 70 years.

Hole KM-23-103 cut 10.5 metres grading 6.2% copper equivalent composed of 2.4% copper, 3.25 grams gold per tonne, 6.1% zinc and 36.1 grams silver from a depth of 386.3 metres, Arizona Metals said in a news release on Monday. The intercept included 2.7 metres at 10.5% copper equivalent and 1.5 metres at 8.9% copper equivalent.

The hole confirms high-grade copper and gold mineralization found earlier in hole KM-21-19 and suggests a high-grade gold zone in the deposit’s western part, the company said. Kay Mine could be part of a much larger property-wide mineralized system, it said.

“The high-grade copper and gold drill results reported today continue to demonstrate the expansion potential of the Kay Mine deposit,” CEO Marc Pais said in the release. “Surface outcrop sampling at the Western target has returned significant grades of both copper and gold, extending the strike length of mineralization exposed at surface in this area to approximately 800 metres.”

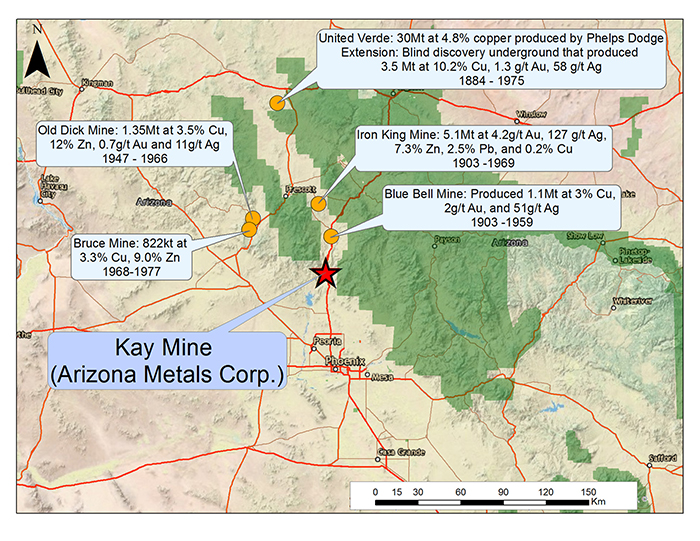

The 5.3-sq.-km project, about 70 km north of Phoenix, lies amid scores of current and past-producing mines in the leading copper-producing state in the United States. Arizona Metals, which in 2018 signed a letter of intention to acquire the site from Silver Spruce Resources (CVE: SSE), touts the location as within a two-hour drive of two smelters.

Toronto-based Arizona Metals is drilling the final 1,250 metres in a 75,000-metre phase-two program that began in early 2021 at the site near Black Canyon City in Yavapai county. The company is preparing for a US$32 million third phase to test targets west of Kay Mine and possible northern and southern extensions. It had US$49 million in cash at the end of March.

Also reported Wednesday, hole KM-23-105 cut 7.3 metres grading 4.6% copper equivalent, including 2 metres at 8.7% copper equivalent, from a depth of 553.2 metres. The hole also returned 28.8 metres grading 1.2% copper equivalent, including 2.3 metres at 5.9% copper equivalent from 13.7 metres deeper.

“This hole confirms the excellent continuity, thickness and grade of mineralization within a previously unexplored 50-metre gap in the central part of the Kay Mine deposit,” Arizona Metals said.

The company’s phase-one program in 2020 drilled 6,700 metres on areas explored by the minerals unit of ExxonMobil in the 1970s and ’80s. It reported reserves in 1982 of 6.4 million tons (5.8 tonnes) at a grade of 2.2% copper, 2.8 grams gold per tonne, 3.03% zinc and 55 grams silver.

Exxon didn’t produce ore, nor did subsequent owners after Exxon sold the site to Rayrock Mines in 1990 and Silver Spruce acquired the property in 2017.

Kay Mine dates to a 19th century discovery followed by small-scale mining of 635 tonnes. Kay Copper dropped shafts and built underground levels from 1918 until the company failed because of low metal prices and court action in the late 1920s without producing ore, Arizona Metals says.

From 1949, the site was mined by various operators including Black Canyon Copper, Shattuck-Denn Mining and Republic Metals, producing about 2,730 tonnes until a cave-in closed the mine in 1956. No one has mined it since.

Arizona Metals has also been drilling at the Western target since February. The first two holes, KM-23-104 and branch hole KM-23-104A, have been completed and assays are currently pending.

Arizona Metals owns the Sugarloaf Peak property, an open-pit target about 200 km west of Phoenix. It has an historical resource of 1.5 million oz. at grades of 0.5 gram gold per tonne.

Shares in Arizona Metals gained 2¢ to $3.32 apiece on Wednesday afternoon trading in Toronto, within a 52-week range of $3.23 to $5.13, valuing the company at $381.7 million.

Be the first to comment on "Arizona Metals probes copper-gold deposit at decades dormant Kay Mine "