Canadian exploration outfit American Pacific Mining (CSE: USGD; US-OTC: USGDF) on May 2 agreed to buy privately held Clearview Gold in a deal valued at $5 million, thus adding a third well-heeled joint venture (JV) partner to its fold.

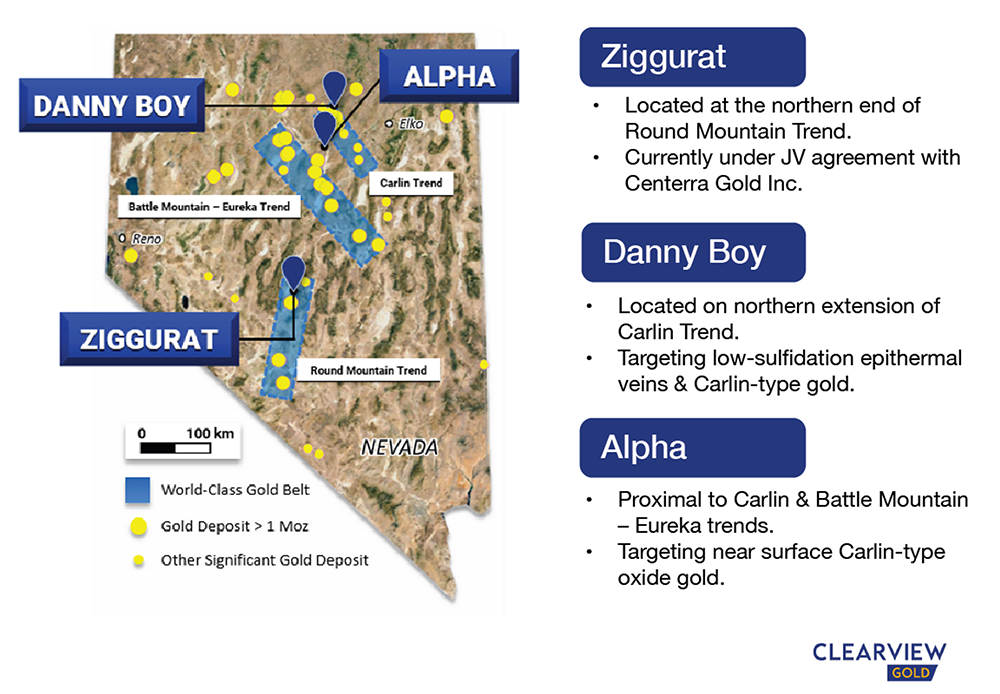

The deal hands American Pacific control over three gold properties in Nevada, including the Ziggurat project on the northern end of the Round Mountain trend. It is close to other million-ounce-plus deposits.

The Ziggurat project was under an existing JV between Clearview and Canadian mid-tier Centerra Gold (TSX: CG; NYSE: CGAU), which is planning an active second season on the property this summer.

Under an option agreement, Centerra can earn 70% in Ziggurat by spending US$6 million over five years. American Pacific will pay $200,000 in cash and issue 11.5 million common shares to Clearview.

American Pacific also holds a JV partnership with Rio Tinto’s (NYSE: RIO; LSE: RIO; ASX: RIO) Kennecott Exploration on the Madison copper-gold project in Montana. Including its more recent deal with Japan-based Dowa Metals and Mining (DOWA) on the Palmer zinc-copper-gold-silver volcanic massive sulphide project north of Haines in Alaska, American Pacific expects upwards of US$37 million in partner-funded exploration spending on its assets this year. That leaves it free to work on its own grassroots Gooseberry gold project in Nevada.

For American Pacific, which has a $65-million market cap, to have a $37-million exploration budget this season is unique. By comparison, Smith says Hecla Mining (NYSE: HL) spent about US$29 million in the U.S. last year, and Coeur Mining (NYSE: CDE) spent US$23 million. “Those are US$3.5 billion and a US$1 billion market caps, respectively, compared to ours,” Smith says.

Smith says Centerra has outlined 16 priority targets at Ziggurat this summer, and they’ll spend about US$1.3 million.

At the Palmer project, which the company acquired in August last year through its acquisition of Constantine Metal Resources, Smith expects DOWA to spend about $25.5 million. He also hinted that news is coming from the advanced Madison project, where Kennecott has been involved since 2019.

As part of the transaction, Anglo Pacific will get the Danny Boy property on the northern extension of the Carlin trend, next to American Pacific’s Tuscarora property, where Clearview has been exploring for epithermal and Carlin-type gold, and the Alpha project, which is close to the Carlin and Battle Mountain-Eureka trends. Previous exploration has targeted near-surface Carlin-type oxide gold at Alpha.

At the early stage 100%-owned Gooseberry project, American Pacific has started a US$500,000 drilling campaign for about 3,000 metres. Smith explains that American Pacific identified a second unmined vein last year, with evidence pointing towards the potential for two more. The single-veined Gooseberry deposit had previously produced 1 million oz. gold.

Like most gold juniors, American Pacific’s shares have been under pressure over the past year. The company’s stock last traded at 38.5¢, down 42% over the past 12 months after touching a high at 87¢ and a low at 27¢, giving it a current market capitalization of $68 million.

Be the first to comment on "American Pacific adds Centerra Gold to roster of prospecting partners"