Singapore-based Silver Bullion is expanding its The Safe House precious metals vault in Changi and will be moving into newly renovated facilities within what it calls “The Reserve” by the final quarter of this year.

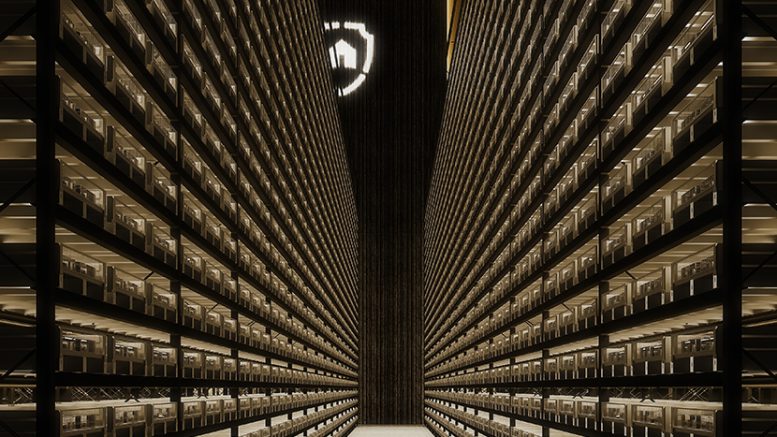

The Reserve will be one of the world’s highest capacity precious metals vaults, a 180,000-sq.-foot facility capable of storing 15,000 tons of silver and 500 tons of gold. It will host bullion storage, private safes, and safety deposit boxes.

Additionally, The Reserve aims to bring together hard asset dealers storing jewelry, fine art, and high-end watches who can rent space and have access to secure logistics services for their business operations.

The facility, which can also house other rare metals, such as indium, and electric vehicle battery metals, like nickel, essential to the energy transition, has onsite testing labs that will authenticate metals prior to storage. With the LME’s recent ‘rocks for nickel’ fiasco, markets are increasingly seeking secure storage solutions.

Silver Bullion says The Reserve is a unique venue because it combines high bulk storage capacities with the latest in vaulting technologies while providing event and auction areas as well as testing and authentication labs for physical assets, ranging from luxury watches to rare industrial metals.

With world wealth hub Switzerland’s reputation tarnished as a result of Credit Suisse’s takeover by UBS, and the U.S. SVB banking crisis demonstrating a need to diversify wealth into safe-haven assets like physical gold and silver, Singapore is increasingly seen as a strong alternative jurisdiction to hold wealth.

The Reserve is the vision of Silver Bullion founder and CEO Gregor Gregersen, who recognized during the financial crisis of 2008 the losses that could be incurred by keeping all of one’s assets in the financial markets, and realized how underserved the market for investment grade precious metals was in Singapore. Under Gregersen’s direction, Silver Bullion launched in 2009 and was pivotal in developing this market locally. The company has since expanded its wealth protection services to international clients.

Silver Bullion founder and CEO Gregor Gregersen. Image by Silver Bullion.

“We have built and maintained customer trust over decades. Our clients are very loyal because we have gone well beyond industry norms to holistically protect their stored assets,” Gregersen says. “We are now storing over a billion SGD worth of precious metals for customers all over the world.”

Gregersen notes that physical liquid assets like precious metals, owned as intrinsically valuable private property without counter-party risks, are a way to not only insulate, but profit from potential future inflation, bank defaults and currency crises.

The Silver Bullion founder emphasizes that Singapore is an attractive location to store metals as it is a stable, well-funded, trusted jurisdiction that is unlikely to nationalize gold in a crisis and is politically neutral.

“Choosing to store gold and silver in Singapore, a politically neutral country with no net debts, a fully funded pension system, and is well positioned to weather upcoming financial storms, is a prudent choice,” Gregersen says, noting that Singapore has well-enforced property ownership rights — and investment-grade precious metals are exempted from the sales tax, and there is no capital gains tax.

“As more people understand the need to own physical precious metals in times of systemic crisis, there is a need to provide trustworthy, transparent, long-term storage of these assets. The Reserve is being built to address, and surpass, these needs,” Gregersen says.

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Silver Bullion and produced in co-operation with MINING.com. Visit: www.silverbullion.com.sg for more information.

Are gold transactions reported to any government entity such as the US govt.