Canadian explorer Golden Arrow Resources (TSXV: GRG; US-OTC: GARWF) holds a portfolio of precious and base metal projects in Argentina and Chile.

Golden Arrow is part of the Grosso Group of companies, which has been working successfully in Argentina since 1993, where it has been involved in several major discoveries, including the Chinchillas silver deposit, now owned by SSR Mining (TSX: SSRM; NASDAQ: SSR; ASX: SSR), and Blue Sky Uranium’s (TSXV: BSK) Amarillo Grande uranium-vanadium project.

In March, Vancouver-headquartered Golden Arrow expanded its footprint in Chile following the acquisition, through its wholly-owned subsidiary New Golden Explorations Chile SPA, of the San Pietro iron-oxide gold-copper (IOGC) project, formerly owned by Sumitomo Metal Mining Chile Ltda.

Brian McEwen, Golden Arrow’s vice-president of exploration and development, says the company “had spent a significant amount of time shopping around for projects to purchase but what was out there was very expensive and not worth pursuing.”

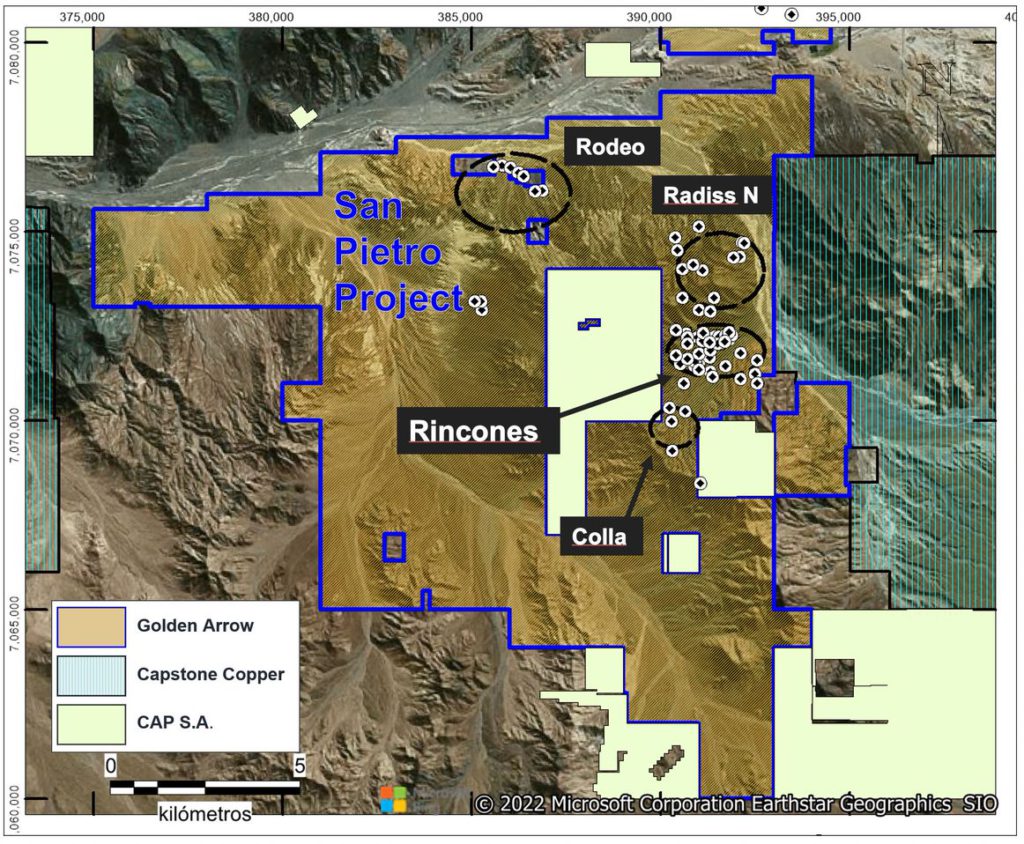

Four main targets being explored at San Pietro. GOLDEN ARROW RESOURCES

“Then, in September, we received a call asking if we’d be interested in looking at San Pietro. The owners, Sumitomo Metal Mining Chile Ltda, were looking to offload the property. We did our due diligence on the project and then successfully bid for it, completing the acquisition in mid-March.”

He says it was the sale of the company’s remaining interest in the Chinchillas project in Chile, a Golden Arrow discovery that was eventually sold to SSR Mining, which “left us with a healthy bank account and allowed us to make a cash payment of US$3.35 million for a 100% interest in San Pietro.”

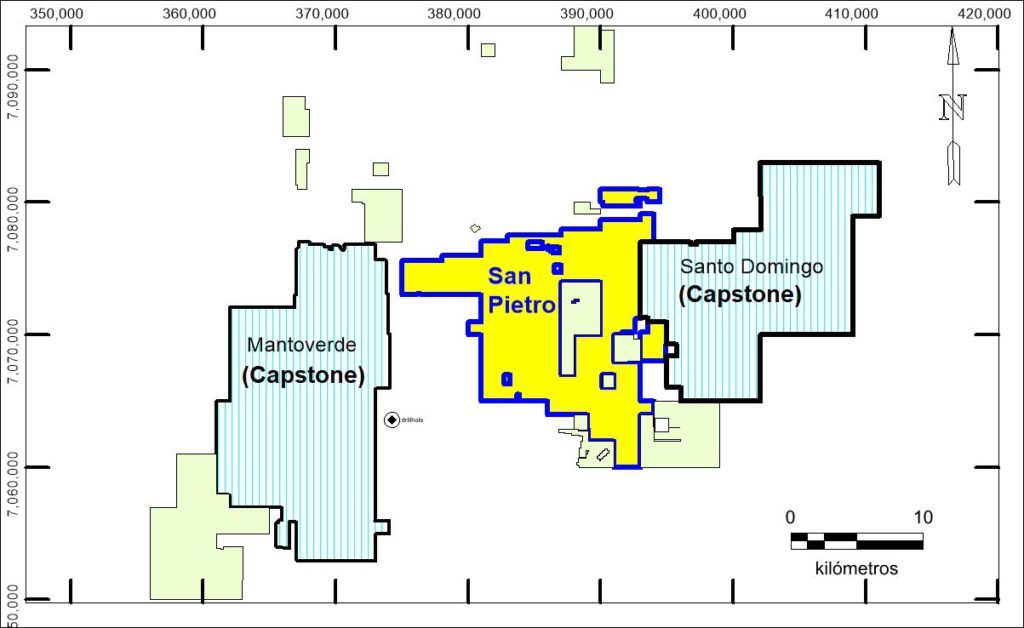

The 184.5-sq.-km property is located in the Atacama region of northern Chile, approximately 100 km north of the city of Copiapo, in a well-established mining district that boasts excellent infrastructure and hosts all of the country’s significant IOCG deposits. These include Capstone Copper’s (TSX: CS) Santo Domingo, immediately adjacent to and east of San Pietro, and Mantoverde, approximately 10 km to the southwest.

San Pietro “sits right between these two projects (with Mantoverde a producing mine and Santo Domingo being developed into a mine), which contain over a billion tonnes of combined resources,” McEwen says.

The project, he says, offers near-term resource potential and multiple targets with significant exploration upside and “has seen little to no work conducted on the property since 2014.”

He added that the project’s previous evaluations “were based mainly on copper only — since that time, the price of copper, gold, and especially cobalt have risen sharply.”

“With cobalt now trading at around US$34 per pound, which is approaching nearly ten times the price of copper, and its importance to the clean energy transition where it’s used in lithium-ion batteries, we believe cobalt will play an increasingly important role in the overall economics of the project,” McEwen says.

He noted, for instance, that Capstone recently added a cobalt circuit to its operations at Santo Domingo.

San Pietro land position and surrounding holdings. GOLDEN ARROW RESOURCES

According to McEwen, San Pietro has had nearly US$15 million in exploration carried out by previous owners and hosts multiple targets and an extensive exploration database that includes 34,276 metres of drilling, over 1,000 surface samples, geological mapping, and findings from induced polarization, magnetic, transient electromagnetic, and gravity surveys.

“The work identified four main areas of mineralization — Rodeo, Radiss Norte, Rincones, and Colla. Of these, Rincones has been the primary focus of previous drilling campaigns, with 47 holes drilled on the target returning significant intervals of copper, gold, and cobalt mineralization.”

Highlights from the drilling at Rincones included hole RA12DH-003, which intersected 28 metres grading 1.14% copper, 0.12 gram gold per tonne, and 335 parts per million (ppm) cobalt starting from 236 metres downhole; and RADH-02, which returned 34 metres of 1.2% copper, 0.21 gram gold, and 589 ppm cobalt from 370 metres.

Drilling at Colla, 2.3 km southwest of Rincones, returned significant cobalt intervals, with CO11DH-001 hitting 10 metres of 626 ppm cobalt from 211 metres and CO11DH-002 intersecting 32 metres of 414 ppm cobalt from 116 metres.

The Rodeo target, 7.5 km northwest of Rincones, shows significant copper and cobalt mineralization, with RO12DH-005 intersecting 34 metres of 1.03% copper and 334 ppm cobalt from 120 metres.

Located 2.7 km north of Rincones, Radiss Norte shows near-surface cobalt mineralization, with RADDH-05 returning 29 metres of 306 ppm cobalt starting from surface.

McEwen says that over the next six months the company plans to advance the project by re-logging much of the drill core to better define the existing targets, and undertake surface exploration and geophysics throughout the property to fill in gaps in the sampling coverage and identify additional targets.

“This work will modernize and build the database for the main prospects, particularly Rincones, and refine the targets for a potential resource delineation drill program,” he explains. “We then plan to commence an approximate 40,000-metre follow up drilling campaign in early 2023 to delineate a resource for San Pietro.”

Golden Arrow’s other asset in Chile is the Rosales copper project. In Argentina, its assets include Flecha de Oro gold, Caballos, Don Bosco, and Mogote copper-gold, Potrerillos gold-silver, and Yanso gold projects.

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by GOLDEN ARROW RESOURCES and produced in cooperation with The Northern Miner. Visit www.goldenarrowresources.com for more information.

Be the first to comment on "JV Article: Golden Arrow Resources aims to advance its flagship San Pietro project in Chile"