Noranda Aluminum Holding Corp.’s (US-OTC: NORN) Chapter 11 filing this week underscores the challenges facing the industry south of the border.

The US aluminum producer announced Monday that in March it will idle its single remaining pot line at its primary aluminum smelter in New Madrid, Missouri, after an electrical circuit failure in January resulted in the idling of two other pot lines at the facility.

Kip Smith, Noranda’s president and chief executive officer explained in a statement that challenging market conditions in the aluminum industry and the recent disruptions in its primary business operations led to the decision.

But some analysts point to yet another culprit: the strong U.S. dollar.

“While technical problems may have precipitated the Noranda closure, there is little doubt many of the financial body blows came from the strength of the U.S. dollar hurting competitiveness in the global marketplace,” analysts at Macquarie Capital argue in a research note.

“Of course, we have seen such periods of U.S. dollar strength in the past, which have resulted in similar cuts to U.S. output. What is perhaps more telling, however, is that, even when the currency cycle reverses, these production cuts tend to be permanent in nature.”

Noranda certainly isn’t the only company in the U.S. feeling the pain. In early February, Horsehead Holding Corp. (US-NASDAQ: ZINC) announced that it and some of its subsidiaries had filed voluntary petitions for relief under Chapter 11. Horsehead is the parent company of Horsehead Corporation, a U.S. producer of specialty zinc and zinc-based products and a leading recycler of electric arc furnace dust.

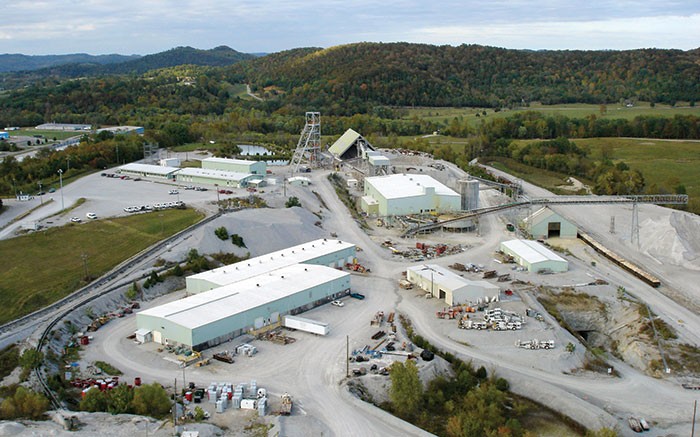

Then, in early January, Nyrstar NV, an integrated mining and metals business with leading positions in zinc and lead, said it was launching a sale process for all or the majority of its mining assets. The news followed a press release in December last year that it was putting its Middle Tennessee Mines on care and maintenance to further minimize cash consumption in its mining segment.

Freeport-McMoRan (NYSE: FCX), which operates seven open-pit copper mines in Arizona and another two in New Mexico, said in late January that its revised plans for its North American copper mines incorporate reductions in mining rates to reduce operating and capital costs.

Those measures have included suspending mining operations at its Miami mine, which produced 43 million pounds of copper in 2015, and the planned shut down of its Sierrita mine, which produced 189 million pounds of copper and 21 million pounds of molybdenum last year. Freeport also said it was making a 50% reduction in mining rates at its Tyrone mine, which produced 84 million pounds of copper in 2015.

Christopher Ecclestone of Hallgarten & Company in the U.K. also points his finger at a strong U.S. dollar, which he argues is punishing producers in the U.S.

“While the big story in commodity circles has been the oil price decline, a far more potent force has been the currency moves,” he writes in a Feb. 3 research note to clients. “The rampant US dollar has ‘saved the bacon’ of many a miner in Australia, Canada, South Africa and elsewhere, while brutally pressure-cooking those that are focused on the mining space in the U.S.”

Ecclestone also makes the point that while major companies can spread the pain of operations in the U.S. across a wider portfolio of international operations, it’s harder for the smaller mining companies to survive.

“With large multinational operations, the very biggest gold miners can apportion costs to mines across borders that can ameliorate some of the pain they may be suffering in their domestic (i.e. US) operations,” he writes.

“However, the longer the agony of the high US dollar goes on, the harder it is to pretend that it is not hurting.”

Be the first to comment on "Strong greenback hits US producers"