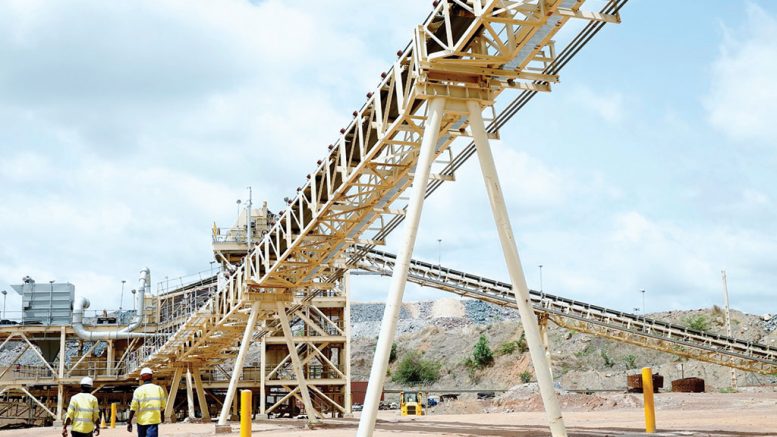

Teranga Gold (TSX: TGZ; US-OTC: TGCDF) has released a prefeasibility study for its Sabodala-Massawa complex in Senegal that shows the project is a “top tier mine” asset, the company says.

The Toronto-based miner bought Massawa from Barrick Gold (TSX: ABX; NYSE: GOLD) in December 2019. After completing the US$380 million-acquisition earlier this year, Teranga began integrating the asset with its flagship Sabodala gold mine, located 20 km away.

Consolidating Massawa, one of the highest-grade undeveloped open-pit gold reserves in West Africa, with the Sabodala mine into one complex, has left the company with a solid asset, Teranga says.

Tier one gold deposits are “company making” mines. They are large, long-life and low-cost, and have an expected mine-life of at least ten years, with annual production of 500,000 ounces or more. Gold and total cash costs per ounce should be in the lower half of the industry cost curve.

Based on the prefeasibility study, Sabodala-Massawa meets all those requirements. Its reserve base stands at 4.8 million oz. gold (75.79 million tonnes grading 1.98 grams gold per tonne). Life-of-mine all-in-sustaining costs (AISCs) are pegged at US$749 per ounce, with total net cash flow of US$2.2 billion at US$1,600 per oz. gold over a 16.5- year mine life.

Teranga estimates Sabodala-Massawa’s average annual production for the 2021-2025 period at 384,000 oz., at AISCs of US$671 per ounce.

“The integration of Sabodala and Massawa is perhaps the best example in mining of the ‘greater than the sum of its parts’ concept,” CEO Richard Young said in a press release. “The sum of Massawa, one of the highest grade open-pit deposits in Africa, and our flagship Sabodala mine is more than simply adding one large gold reserve to another.

Integrating Sabodala and Massawa yields significant synergies, with the combined entity expected to generate net cash flows of $1.1 billion over the first five years and deliver a net present value of $1.6 billion compared to less than a billion dollars for the two assets on a standalone basis.”

Teranga has begun digging up at Sofia, the first of the Massawa deposits to be mined. Processing of free-milling, high-grade ore through the Sabodala plant is “scheduled to begin shortly,” the company said.

The miner has also kicked off a US$10-million exploration and drill program at Massawa.

“We believe in the great potential of this project and are conducting an aggressive drilling campaign for both refractory and free-milling ore, with a goal to sustain Sabodala-Massawa’s gold production between 350,000-400,000 ounces per year beyond 2026,” Paul Chawrun, the company’s chief operating officer, said in the July 27 press release.

The company also plans to issue a revised life of mine production schedule this quarter for its new Wahgnion gold mine in Burkina Faso, where “the plant is exceeding initial performance expectations” following a strong first full quarter in March.

— This article first appeared in MINING.com.

Be the first to comment on "Teranga Gold says Senegal mine a ‘top tier’ asset"