Despite coming off recent highs, the Toronto-quoted shares in copper explorer American Pacific Mining (CSE: USGD; US-OTCQB: USGDF) continue to trade nearly 520% higher over the 12-month frame following a third successful drill campaign by partner Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) at the Madison project in Montana, says CEO Warwick Smith.

The company’s wholly-owned Madison copper-gold project is currently under an earn-in with an option to joint venture agreement, whereby Rio, in a June 2020 agreement, undertook to spend US$30 million to earn up to 70% of the project.

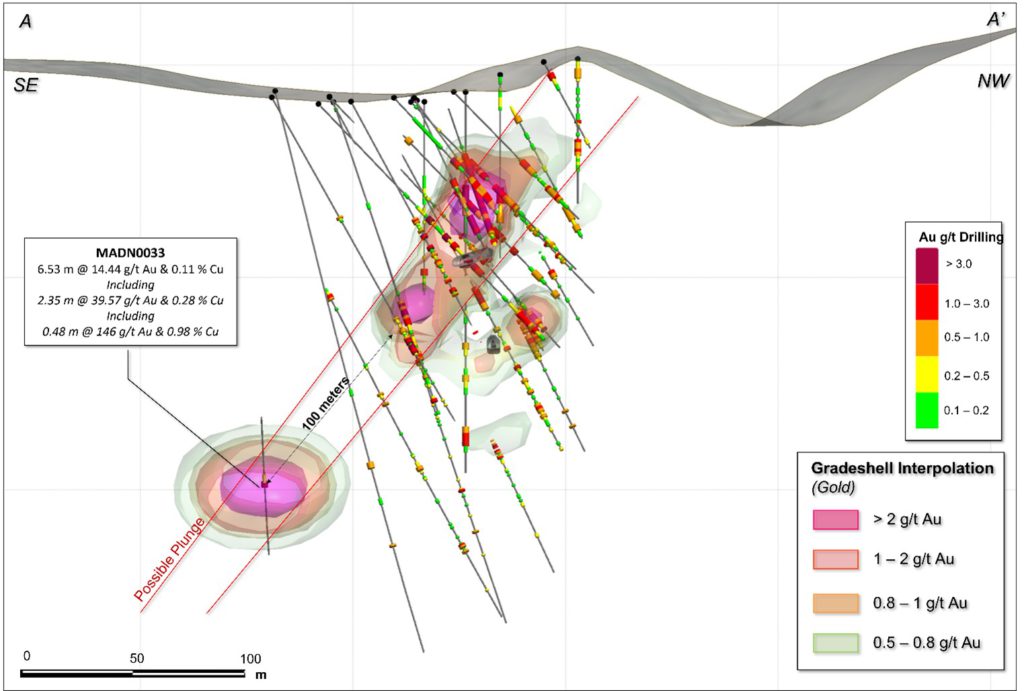

According to Smith, Rio liked what they saw in the drill cores. Of note was drill hole MADN0033, which Smith singled out as a highlight for two reasons.

It cut 14.44 grams per tonne gold and 0.11% copper over 6.53 metres, including 39.57 grams per tonne gold and 0.28% copper over 2.35 metres and 146 grams per tonne gold and 0.98% copper over 0.48 metres – representing the third-highest gold intercept ever reported at Madison between 175 and 225 metres depth.

The hole had also identified a new gold zone 55 metres from the nearest drill intercept and 100 metres down dip.

According to Smith, the hole demonstrates the potential to extend high-grade gold-copper mineralization down the plunge.

“It will be the vector for additional drilling in the currently known mineralized area in 2022,” he said in a recent interview.

Of the ten holes drilled, nine encountered mineralization anomalies in a broad array of different rock lithologies. The Madison deposit contains several gold and copper mineralization styles, all of which can carry substantial metal values.

“This is an important point to emphasize. Every drill hole is essential for making deposits like Madison become mines,” said Smith.

“Hole MADN0033 also shows highly anomalous gold mineralization in iron-rich skarn and warrants exploration drilling follow-up. Every drill hole from 2019 to 2021 has helped define the currently known mineralization further and provided ample exploration vectors for additional targets both laterally and down-dip,” said Smith.

Another recently released drill hole had geoscientists paying close attention. According to Smith, drill hole MADN0032 returned “strongly anomalous gold values” encountered in a limestone rock package that had previously not been known to host mineralization. MADN0032 intersected 1.64 grams per tonne gold over 9 metres within limestone breccia beyond the skarn, highlighting the potential for additional gold-bearing styles of mineralization at Madison.

Meanwhile, Smith said American Pacific’s attention was turning towards identifying regional targets on the property. The geochemical and geophysical programs in 2021 across the property have identified several strong anomalies well away from the current drilling under evaluation. These will be presented as they are interpreted, and additional targets emerge.

“We look forward to collaborating with our partner in the coming weeks to complete further modelling, analysis and define future exploration plans,” said Smith.

Underpinning this work results from a drone magnetic survey of 344-line kilometres at 25 meters and 50-metre spacings over 11.34 sq.km. of land.

“The newly defined magnetic high anomalies are much more pronounced than expected and are interpreted by American Pacific geologists as the late-stage intrusions essential to any copper-gold porphyry and skarn system. These anomalies are often responsible for the strongest gold and copper mineralization in these systems. This survey’s number of untested targets suggests property-wide exploration upside remaining at Madison,” said Smith.

Earlier in the year, the team also undertook some trenching two kilometres away from the skarn mineralization. The results returned evidence of epithermal veins with values such as 15 grams gold per tonne or 600 grams silver and 1.5% copper. “They’ve identified several outcropping targets for priority follow-up work,” said Smith.

While the respective companies are yet to decide on the 2022 Madison exploration strategy, Smith would also like to see some drill holes aimed at the potential deep-lying porphyry. “There was a drill hole in 2017 that intersected the porphyry. We’d like them to vector in and go after it,” said Smith.

Up to now, Rio had been primarily interested in the mineralized skarn at Madison, but now other styles of mineralization are becoming increasingly important.

“There are three types of ore at Madison, including the oxidized material, the massive sulphide, and the native copper. And it all runs,” said Smith.

Madison was last in production between 2008 and 2012. It produced 2.7 million pounds of copper at between 20% to 35% copper and 7,600 ounces at 16.1 grams of gold per tonne.

Also in the company’s project portfolio are the Gooseberry gold-silver project and the Tuscarora gold project.

The company recently expanded the Tuscarora project by staking an additional 47 claims totalling 971 acres in Elko County, Nevada. Smith said the company had started work on a $5 million program drilling up to 70 holes for 17,000 metres to test a series of high-grade gold targets at the project in 2022.

The 215-claim, 4,272-acre project consists of many high-grade gold vein targets, including the Grand Prize Target from which the company reported bonanza grade samples of 21,032 grams per tonne gold and 38,820 grams per tonne silver in 2021.

“The idea with Tuscarora is to turn it into a million-ounce gold deposit at which level its future options become clearer,” said Smith.

Thanks I have been keeping up with your project at the Broadway-Victoria claim group West of Silver Star Montana mining project as I was one of the first Geologist that hired on and managed to oversee the roads, office site, crushing, and shipping circuit as well as the original drilling and core sampling etc. so I am always interested in receiving emails of your ongoing mining projects. Russell W. Scruggs