The following is an edited Investment Update from the World Gold Council. For the full report, visit www.gold.org.

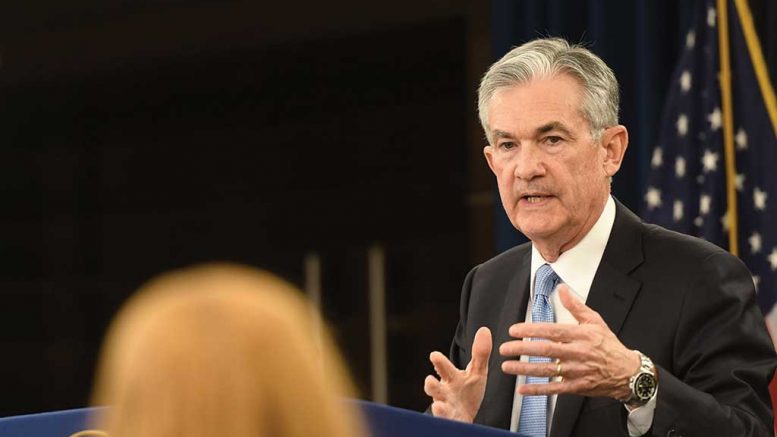

The latest U.S. Federal Reserve Open Markets Committee meeting on March 20 confirmed market expectations that the Federal Reserve (Fed) will remain on hold for the rest of the year. This, in turn, will likely influence gold’s performance. Our historical analysis shows that when the Fed has shifted from a tightening to a neutral stance, gold prices have increased, even if this effect has not always been immediate. In our view, the combination of rangebound U.S. interest rates, a slowdown in the appreciation of the U.S. dollar and continued market risks will continue to make gold attractive to investors.

The relevant question for gold investors is, if monetary policy is about to shift from tightening (higher rates) to neutral (steady rates), should this be positive for gold?

As such, we look at the historical performance of gold and major assets during past hiking cycles as well as during periods when policy has transitioned from tightening to neutral, and, eventually, easing.

The immediate average effects (one to three months) of a transition in policy from tightening to neutral on gold are not clear-cut. Reasons for this could be:

- Uncertainty over whether hiking might resume;

- Falling inflation or lower risk of rising inflation — generally seen as bad for gold;

- Shift in investor allocation to safe fixed income (government bonds, cash) from riskier assets, in lieu of allocations to gold; and

- An uncertain dollar trajectory: rates argument for dollar likely weaker, but safe-haven argument building.

Not all cycles show such parallels. The current cycle shares more similarities with the last two: 1999–2000 and 2004–2007, although those periods did experience rate cuts. This suggests potential for rising gold prices in the intermediate term.

- Rates had been rising without pause for at least 12 months in both cycles;

- The yield curve was flat or inverted in both cycles;

- Retail sales were falling in both cycles;

- Credit conditions were worsening (2006–2007);

- Risk assets’ valuations were unusually extended (2000); and

- The oil price had peaked (2000).

Based on the most recent cycles, our analysis indicates that gold does perform better in a post-tightening cycle, but the period over which this occurs varies. For example, gold rose 3.6% in 2001 — 12 months after the Fed stopped raising rates. But it rose 7% only one month after the transition in 2007, a trend that continued, as it was 19% higher 12 months after the Fed’s last hike.

Gold generally outperformed stocks and the broad commodities complex during these same periods. It also outperformed U.S. government and corporate bonds in the more recent post-tightening cycle — coinciding with the 2008–2009 financial crisis — and this was most likely as a result of more widespread systemic risks.

While no clear evidence points to an immediate positive impact on the gold price after the Fed pauses, historical analysis suggests that gold eventually reacts positively as the pause cycle extends and/or the Fed eases monetary policy.

Historical post-tightening periods have shown an eventual strong gold performance, counterbalancing the performance of risk assets such as stocks or commodities, and complementing — sometimes even outperforming — assets such as treasuries and corporate bonds.

Other factors

Outside the U.S., the European Central bank surprised markets in recent months by extending its asset purchase programme. Yet unlike U.S. Treasuries, the bond markets in Europe and the U.K. are still pricing a positive, if small, chance of a rate hike this year. This, combined with continued uncertainty around trade negotiations between China and the U.S., may likely slow down the appreciation of the U.S. dollar.

If, indeed, the Fed were to signal a more dovish stance and the U.S. dollar remains rangebound, this will likely remove some of the strong headwinds that gold faced in 2018.

There are also more risks to global financial markets, including:

- The long duration of current recovery — seen as a potential sign of economic exhaustion;

- Flattening and inversions of key yield curves, with the lack of investment-driven growth indicating possible recession;

- Continued lofty valuation of stock markets at levels last seen during the dot-com bubble on a CAPE ratio — highlighting potential volatility bouts;

- Deteriorating credit conditions at both the consumer and corporate level; and

- Continued uncertainty surrounding Brexit timing and implications.

Combined, these factors may support investment demand by providing an entry point for investors looking to add gold to their portfolios as a source of returns, diversification, liquidity and portfolio impact.

Be the first to comment on "Metals Commentary: Fed policy shift should be good for gold"