BMO Capital Markets analyst Colin Hamilton is raising his molybdenum price forecast to US$10.75 per lb. for 2018.

“Having been stuck in a range of US$7 to US$9 per lb. from January to November 2017 as peer industrial metals recovered, latest spot molybdenum oxide quotes are currently above US$11 per lb. for the first time since September 2014,” Hamilton writes in a research note.

The analyst argues that a recovery in the oil and gas sector, combined with a wider global industrial recovery and a crackdown on pollution in China, all point to a “more positive demand environment” for the metal.

Molybdenum increases the strength and corrosion resistance of steel alloys and is used in a variety of industries. But Hamilton estimates that one-third of demand for the metal comes from the oil and gas sector, where it is used in pipelines and as a processing catalyst in refineries.

“What is unique for molybdenum is its degree of exposure to oil, gas and petrochemical markets,” he writes in his research note. “This is significantly higher than for peer metals. And of course, the recovering oil price and resulting recovery in free cash flow at producers and associated service providers has led to an end of destocking through this supply chain, if not the beginnings of a restock.”

Hamilton cites Caterpillar’s November retail statistics, for example, provided by BMO machinery analyst Joel Tiss, which indicate a 43% year-on-year sales increase in the company’s oil and gas business. The most recent data from Baker Hughes, an oilfield service provider, notes there are now 400 rigs in the Permian basin compared with 267 a year ago.

Meanwhile, efforts to reduce pollution in China, where much of the primary supply of molybdenum comes from, “adds fuel to the fire through potential supply restrictions,” Hamilton contends.

“Molybdenum is often thought of as a by-product commodity,” he says. “However, primary supply has provided 40% to 50% of units in recent times, with the majority of this coming from China.”

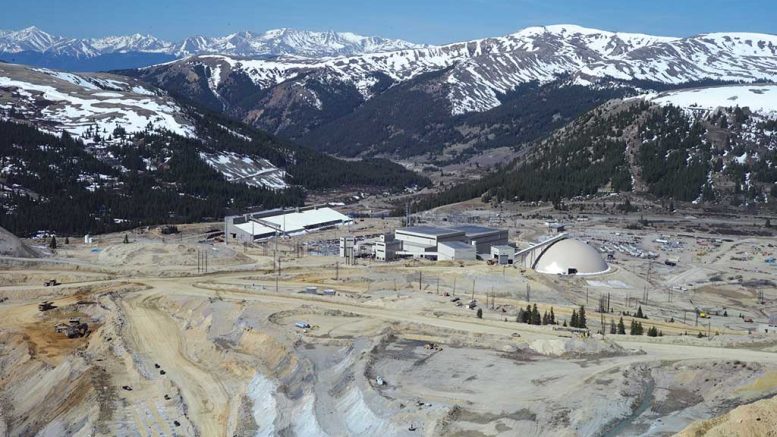

The Davidson molybdenum project near Smithers, British Columbia. Credit: Darnley Bay Resources

Primary molybdenum output in China in 2013 totalled 200 million lb. molybdenum (36% of global mine supply), but fell to an estimated 130 million lb. in 2017, or 25% of global output.

“The effect of the output fall can be seen in Chinese molybdenum concentrate imports, which have risen sharply over 2017 as downstream processors seek alternative units,” Hamilton writes. “First-half 2017 imports are almost triple that seen in the first half of 2015.”

“The drop in Chinese primary output has been partially offset by rises in molybdenum by-product recovery, which has risen by almost 30% since 2013,” he continues. “Even with this, however, global output remains lower than the 2011 to 2015 level.”

The analyst also predicts that other sources of molybdenum such as Chile and Peru will struggle this year “to match production levels seen in the second quarter of 2017.”

To be sure, Hamilton doesn’t expect the strength in molybdenum “to last forever,” and says that even if you take China out of the equation, there is “potential elastic supply response.”

He adds that “many copper miners are either not running or are under-utilizing their molybdenum circuits, and while ~US$7 per lb. spot prices didn’t encourage this supply to market, greater than US$10 per lb. probably does. At these levels, potential restarts of primary mines outside of China also become feasible. Moreover, it is difficult to see current demand strength being sustained.”

His price forecast for the metal in 2019 is US$9.50 per lb. and has a long-term equilibrium price of US$7.50 per pound.

For now, though, higher prices will flow through to higher company earnings for copper producers that produce molybdenum as a by-product credit, he predicts.

Hamilton has raised 2018 and 2019 estimates for earnings before interest, taxes, depreciation and amortization (EBITDA) for seven companies he covers.

Hamilton estimates 2018 EBITDA will rise 5.8% for Taseko Mines (TSX: TKO; NYSE-AM: TGB); KGHM, +4.5%; Freeport-McMoRan (NYSE: FCX), 3.9%; Antofagasta (LON: ANTO), +2.5%; Hudbay Minerals (TSX: HBM; NYSE: HBM), +1%; Kaz Minerals (LON: KAZ), +0.9%; and Teck Resources (TSX: TECK.B; NYSE: TECK), +0.7%.

Greenland Resources Inc recently acquired the world class Malmbjerg molybdenum project in Greenland.