We are all familiar with the principles and practice of recycling and re-using, and for many it is a common practice of daily life. Our society has a long history of recycling glass, aluminium cans, plastic (in all its forms), cars, scrap metal, jewelry, electronics, paper and so on. We increasingly re-use clothing, vinyl is back and vintage wear is now a high-fashion statement. What if reduce, reuse and recycle applied to everything? Then you have an idea what the Circular Economy is about.

Massive change is occurring in the metals and minerals industry. The status quo is no longer societally acceptable. Investor expectations of excellence in ESG (Environment, Social, Governance) performance continue to rise. Our industry also has a unique potential to accelerate progress on the Sustainable Development Goals during the Decade of Action, called upon by the United Nations. Now, we are also starting to become aware of the circular economy and our role in it.

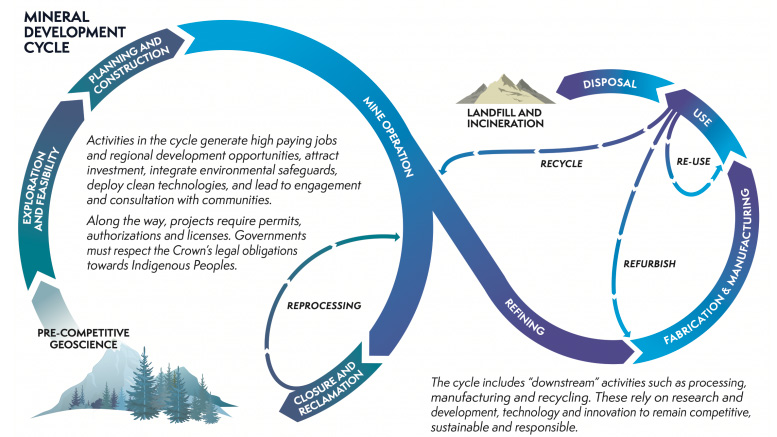

But firstly, what is the circular economy? For many of us this is a relatively new concept. Since the industrial revolution, our perfectly oiled economy has operated as if raw materials and energy were infinite. But we are reaching the limits of both our finite planet, and business-as-usual. The circular economy offers an alternative, summarized as an economic system that encompasses and encourages resource recycling, reuse, repair and remanufacturing, ultimately creating a circular closed loop system which minimises the use of new mined product. In other words, compared to the prevailing linear take-make-waste economy, it avoids the use of non-renewable resources, and preserves or enhances renewable ones. In so doing, it aims to improve the productivity of resources, design out waste and pollution, and keep products and materials in use for longer, while regenerating the natural systems upon which our existence is dependent.

The circular economy concept is being adopted by governments around the world, including the Government of Canada. It features in Canada’s own ‘Canadian Minerals and Metals Plan’ calling for a national strategy and global positioning of the country as a continued world leader in the mining sector. The concept is not, however, just in the arena of policy makers. Increasingly, major mining companies are building circular concepts into their long-term strategic planning and modelling, signaling a transformation from virgin mineral product miners to metals and minerals solution providers.

Circular principles like reprocessing, repurposing and designing out waste aren’t new to our industry. We apply them regularly to increase efficiency, and reduce waste, water or carbon footprints. The concept of value from waste is not a stretch. Ninety percent of tailings produced in Canada each year come from metal mines, still retaining plenty of recoverable and valuable material, such as rare earth elements, gold, nickel, cobalt, and tungsten. Further, waste rock, tailings, slag and rock dust can be repurposed for applications from construction materials, to solar energy, to agricultural soil additives and more.

However, the implications for the mining industry are far more profound than just site-level efficiencies. Recycling activity across all metals and mineral commodities is set to exponentially intensify in the coming years. Primary producers will soon face tough competition from recyclers as end use consumers demand to know product content provenance and recycled products become ever more desirable by virtue of their being more ‘green.’

Moreover, research studies in recent years have suggested impressive cost and energy efficiencies. One in 2018 showed raw extraction costs thirteen times as much as e-waste “urban mining”. European Union research indicates that recycling just forty-one mobile phones can yield as much gold as one tonne of 1 g/t ore – there are over 14 billion mobile phones in the world. Notably, downstream sourcing decisions will immensely impact efforts to meet corporate Net Zero Green House Gas (GHG) emissions targets, depending on whether these decisions are based on linear or circular principles. For example, recycled steel in manufacturing reduces energy use by a whopping 95%. Similarly, a single tonne of recycled aluminium saves nine tonnes in CO2 emissions.

Massive change is occurring in the metals and minerals industry and the circular economy is now more important than ever. (Credit: Elizabeth Freele)

For some, the future is now. Already, around half the copper demand in Europe is met by recycled material. Already, thirty percent of ArcelorMittal’s steel is made using scrap instead of iron ore. Already, one of the world’s preeminent recyclers, Nucor, has become the largest North American steel supplier. In 2019, the company recycled 16.1 million tonnes of scrap and earned revenue of US$22.6 billion!

Already, Apple’s MacBook Air chassis is manufactured from 100% recycled aluminium. The list goes on. As the Cleantech Boom 2.0 begins, startups like Li-Cycle and Redwood Materials are popping up, adopting closed-loop, highly-efficient new recovery processes and gaining notable market share from customers such as Amazon and Panasonic. And where startups aren’t satisfying demand, companies like Tesla, Audi, BMW, Volkswagen, Groupe Renault and more are rapidly stepping up to create their own recycling loops, either fully in-house or through new partnerships.

In the Li-Cycle example their mission is “Making lithium-ion batteries a truly circular and sustainable product.” Of note, is the significant involvement and investment of mining executives, both on management and as backers, in TechMet. This month the company increased capacity to 10,000 tonnes per year to become North America’s largest spent lithium-ion batteries recycler.

Like circular economy principles, such vertically-integrated business models are not new to mining. In the late 1800s and early 1900s, Mitsubishi and Henry Ford went on coal mine buying sprees to secure their value chains. Over time, we’ve also seen stories like the Minnesota Mining and Manufacturing Company going from miner to STEM manufacturer, and Lakshmi Mittal going from steel manufacturer to ArcelorMittal, vertically-integrated miner and multi-product, multi-market company.

The Macbook Air chassis is just the beginning – Apple has pledged to eliminate waste through circular supply chains, with ALL their devices made from recycled or renewable sources. Their in-house disassembly robots continue to evolve, from Liam, to Daisy, to Dave, now recovering 29 ounces of gold, 240 ounces of silver, and nearly 2 tonnes of aluminum for every 100,000 iPhones deconstructed (which only takes 500 hours). In a smartphone first, the iPhone’s Taptic Engine now sports 100% recycled rare earth elements.

While some traditional metal and mineral buyers will create their own circular product loops, many others will want to stick to their core business. This presents the emerging opportunity of access over product ownership models, know as servitization or Product-As-A-Service (PaaS). After orbiting the business world for over fifty years, this business model is now taking off in every corner of the global economy. Moving well beyond newer household names like Uber, AirBnB or Car2Go, countless PaaS applications have already been adopted by long-established companies: Philips leases lamps; Rolls-Royce, jet engines; Michelin, tires; Xerox. copy machines. What will “metal-as-a-service” offered from a minerals solutions company look like? Not only will it be cost-effective and highly profitable, but also offer the added advantages of being both low-carbon and completely traceable.

Recently, on October 7th, 2020, Coreo and the Circular Economy Leadership Coalition in collaboration with the Canadian Government heard in a keynote from Mark Cutifani, CEO of Anglo American: “There is a strong rationale for us to engage with the circular economy that is strategic both from a planetary boundaries perspective and in order to support and accelerate our company’s ambitions. Furthermore, our customers are demanding it…If I look back over the years, we have characterized ourselves as a mining company, today we characterize ourselves as a metals and mining company, and tomorrow we could very well be categorizing ourselves as a materials solution company.”

Megatrends of emerging technology, disruptive innovation, supply chain volatility, sourcing transparency, resource scarcity, social unrest, climate change and economic anxiety are converging to accelerate the circular economy trend as part of our collective progress on at least 7 of the 17 Sustainable Development Goals.

As we move towards a future powered by ‘green metals’, circular closed loop industrial models will become the norm, not the exception. This shift invites the reimagining of the linear mineral extraction business as we know it. While raw extraction isn’t going away any time soon, opportunities for new business models, including integrated materials companies, mineral solutions providers, and even closed-loop metal-as-a-service offerings, will emerge. These are opportunities that mining companies are well-positioned to seize. Lose or acquire market share, disrupt ourselves, or be disrupted. The choice is ours.

— Andrew Cheatle is a mining executive/director and geoscientist. He is passionate about the mining industry’s role in community and national development. Elizabeth Freele is a conscious capitalist, futurist entrepreneur, management consultant, and impact investor dedicated to building better-world-business. She is the founder and CEO of 4P-Solutions Inc.

Be the first to comment on "Quo Vadis? Mining, metals and minerals in a circular economy"