Industrial and retail demand for silver through last year into January pushed prices over $90 an oz. for the first time in history as it outperformed gold, the go-to safe-haven metal in turbulent times.

Silver and platinum last year gained 143% and 137%, respectively, compared with gold’s 65%. Inflows into silver exchange-traded funds have surged, while demand from solar panels and electric vehicles has tightened the physical market to an unprecedented degree, BMI, a unit of Fitch Solutions, says in a report this week. It forecasts a silver deficit through this year, primarily on higher investment demand.

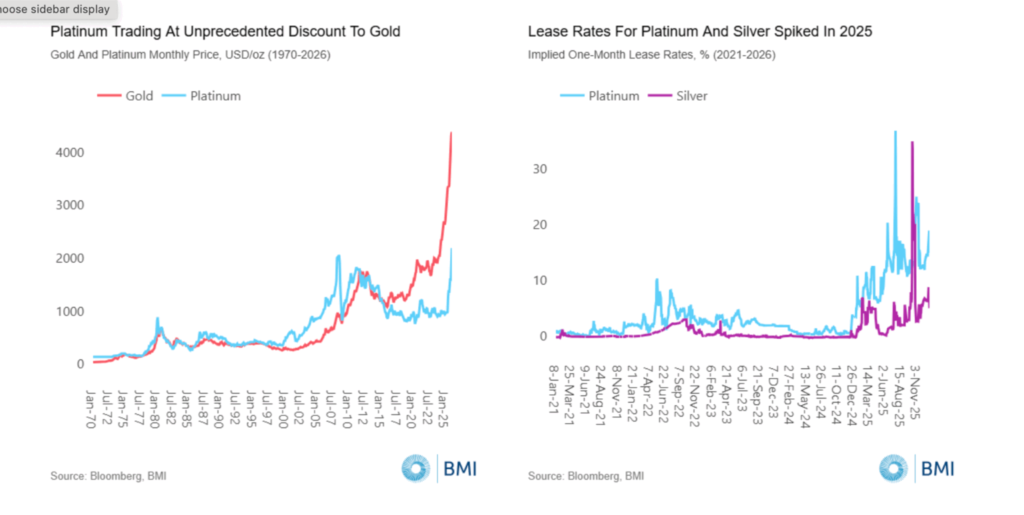

“As non-yielding assets, silver and platinum have both benefited from interest rate cuts,” BMI said. “But they have also indirectly benefited from the elevated gold price, which has made both metals cheap relative to gold in investment portfolios, jewellery and various industrial applications.”

Analysts maintained that even so, prices remain highly volatile, with positioning from non- commercial speculators dictating price movements and demand from central banks, a key driver of gold prices, playing no meaningful role.

Chinese curbs

Since Jan. 1, Beijing has restricted the export of physical silver to the global market, piling additional pressure on inventories in London and Zurich and temporarily pushing lease rates for silver back above 8% on a one-month equivalent basis, BMI said.

Mexico, the world’s largest silver producer, is also unlikely to deliver any significant increase in silver volumes this year due to declining ore grades and a partial cessation of operations at Fresnillo’s San Julián mine, the analysts noted.

By contrast, BMI says the currently elevated platinum price isn’t justified by fundamentals.

Platinum futures now trade above $2,000 an oz. on the New York Mercantile Exchange following the Eurpean Union’s decision to postpone its 2035 ban on sales of internal combustion engine vehicles, which require platinum-intensive catalytic converters.

The postponement, BMI noted, announced on Dec. 16, sparked a 31% rally in platinum prices to an all-time-high of $2,471 per oz. on Dec. 26.

“The sell-off on Dec. 29 saw prices plunge almost 15%, the largest daily decline since August 2001,” BMI said.

“While prices have recovered over the past week, we still expect only a moderate increase in industrial demand for platinum in 2026, with higher recycling rates partially offsetting lower production from platinum mines in South Africa.”

Be the first to comment on "Silver market deficit due all year: Fitch’s BMI "