The title track of The Clash’s 1979 album borrows the urgency of a BBC global news broadcast, the ones that used to proclaim “this is London calling.” The song is a wake-up alarm: war, climate change and floods are closing in.

How timely today. How metals-related.

One of my takeaways from London, where The Northern Miner just held its most successful International Metals Symposium, is the city’s congestion, yet how sprawling it is at the same time. New York has nothing on it; Toronto is an outpost.

And at Christmas, you can nearly crowd-surf down Oxford Street. That intensity is a decent metaphor for the metals and mining industry looking back over the past year.

The passion was evident at our symposium which attracted more than 650 registered delegates, squeezed them into standing room only for many of the sessions and sold out all sponsorships. Ontario Energy and Mines Minister Stephen Lecce set the tone:

“I’m here really with a message that this province is re-orienting our regulatory regime so that we can be and we are emerging as one of the fastest jurisdictions to get a permit in the country,” Lecce said in a keynote speech at the event.

“In a new world order, post the election of President Trump, we lit a fire under the behinds of every public servant, every agency, board and commission, everyone involved. The message to them and to you is that we’re going to re-imagine and do things better, smarter, faster, with the bias of action.”

Atlantic Canada

Government representatives from New Brunswick, Nova Scotia and Newfoundland and Labrador made similar promises at the symposium, if without the fire imagery and exact timetable talk.

New Brunswick pointed to Northcliff Resources’ Sisson tungsten-molybdenum project making Ottawa’s Major Projects Office list, while Nova Scotia is preparing for construction at NexGold Mining’s fully permitted Goldboro project.

Newfoundland and Labrador has had an active year with Equinox Gold buying Calibre and starting the Valentine mine while New Found Gold ramps up exploration at the nexus of a new yellow metal zone near Gander.

On another panel, we heard about scrambled South American politics – a new right-wing leader in Chile, confusion in Peru and tax breaks easing projects in Argentina. In the midst of it all, executives are trying to reel in illegal gold mining while making projects profitable for communities and companies. The artisanal surge is, of course, driven by record bullion prices.

Gold outlook

We heard why the frenzy in gold is bound to continue during the year: central banks keep buying, while tariff and geopolitical uncertainty from Ukraine through the Middle East to Taiwan and beyond drive safe-haven buying. And now, new players are stepping in, like the token company Tether, which backs up each gold stablecoin with an ounce of stored physical gold.

Tether bought 26 tonnes of gold in the third quarter alone to hold 116 tonnes in total – that’s more than South Korea has and roughly the same as Qatar – to satisfy retail investor demand, helping sustain bullion’s run of record prices.

The intensity has popped now because it’s been a quarter-century in the making, veteran investor Rick Rule told the symposium. Even so, he argued the commodity still has room to run because many institutional investors don’t treat gold as a core part of their portfolios.

In equities, he recently sold a quarter of his junior miner shares in a de-risking move, rotating into streamers and Canada’s top gold producer. He’s evaluating companies on circumstances – and when exploration raises questions that lack answers, the alternative is divestment.

The leading banks and analysts are guesstimating whether gold will hit $5,000 an ounce. J.P. Morgan says it could reach that level by year-end because the current trends aren’t exhausted.

Unified stance

What will be exhausted by this time next year may be something else, perhaps the patience of project developers after all the promises in 2025.

This year could feature a crisis of expectations at some point. Right now in Canada, there appears to be an alignment among provincial and federal governments – Lecce called the feds “collaborative” and “on the same team in this moment” – but when choices have to be made about which projects get dollars and which don’t, cracks may show in the unity.

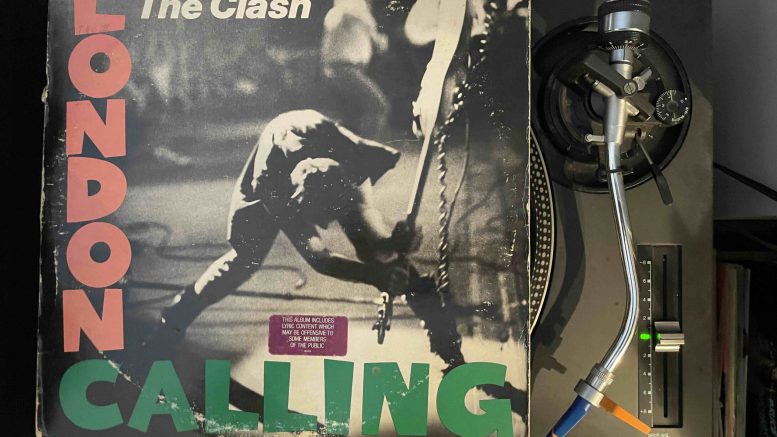

The cover of The Clash’s “London Calling” looks back as well as forward, paying homage to Elvis Presley’s self-titled debut album in 1956 by using a nearly identical design and typography. The striking photo of Paul Simonon smashing his bass contrasts with the more conventional pose of Elvis strumming his guitar.

Are we at a similar crossroads in mining – seeking similar groundbreaking content, but breaking the old rules to how we get there?

Be the first to comment on "Editorial: London calling"