It’s about a two-hour flight north-northwest from the uber-developed Chilean capital of Santiago to reach the dusty airport just outside Antofagasta, a seaside city on the edge of the Atacama Desert, said to be the second driest place on earth after Antarctica.

As we’re driven away from the airport, we pass under a giant BHP-Escondida greeting banner. It’s immediately clear we’re now in big-time copper country. The arid, brown-red landscape here is in stark contrast to the lush greenery of Santiago.

We’ve travelled to view Marimaca Copper’s (TSX: MARI) eponymous brownfields project located about an hour’s drive inland from Antofagasta on well-maintained government roads.

“Marimaca is the only copper discovery globally of the last five years,” says president and CEO Hayden Locke, who adds it’s a “low-risk project with substantial exploration potential.” On the way to the site, Locke points out just how well developed the local infrastructure is., built over decades to sustain one of the most important copper-producing regions in the world. There’s a pipeline pumping seawater for the nearby Mantos Blancos operation and at least four high-voltage powerlines serving the big mines further inland. As we turn into the countryside, a goods train carrying loaded wagons of copper concentrate, copper cathodes and empty vats of hydrochloric acid to the port at Mejillones, slowly snakes its way down from the majestic Andes mountain range.

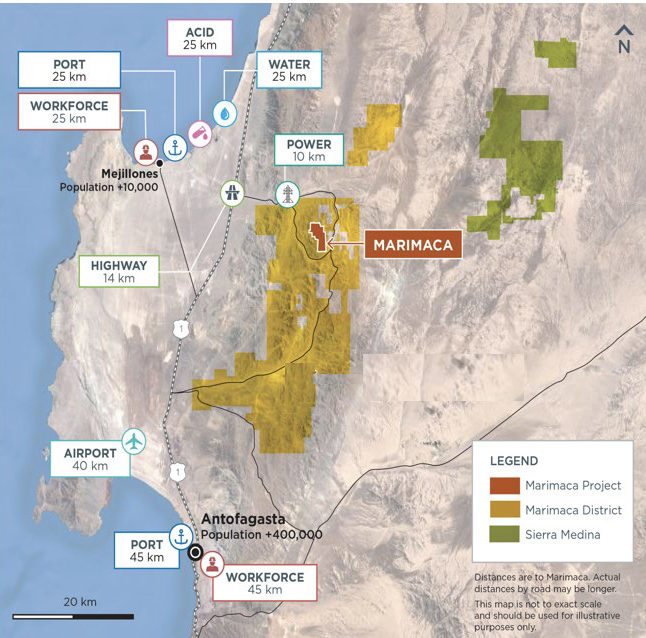

A map showing the location of Marimaca Copper. Credit: Marimaca Copper

The Marimaca project has an exceptional location, just 14 km from the highway and power lines, 25 km from the port of Mejillones and 45 km from the regional capital of Antofagasta.

Locke says Marimaca Copper is making steady progress with advancing a rare, economical copper oxide deposit in the Antofagasta region of Chile, regarded as a Tier 1 jurisdiction and the world’s largest exporter of the future-facing red metal.

The development project is set against a backdrop of exponentially growing copper demand forecasts standing in stark contrast to stagnant supply curves not nearly keeping pace. Analysts predict an annual supply gap of 12 million tonnes opening from about 2025 onwards.

The project represents a small, welcome breath of air, as majors are forced to look for significant discoveries in ever more remote and expensive-to-operate-in places just to sustain current production.

“It becomes clear that a low-cost operation feeding into a high copper-price environment is a recipe to make a lot of money over a relatively short timeframe. Our asset contrasts against the often long, uncertain timelines to permit a massive supergene/hypogene deposit and the considerable capital it requires to see it through to production,” Locke said.

Permitting has become a political juggernaut in Chile. Some see copper mining in danger of becoming more restricted. Chile’s new president, Gabriel Boric, has been busy in recent months rejecting new copper mines and expansions. Anglo American alone has had two copper mine expansions rejected just in the last couple of months.

“From a permitting standpoint, I’m confident Marimaca ticks all the boxes for a rapid review process, so I wouldn’t pay too much mind to negative media reports of development projects struggling to achieve permitting in Chile,” said Locke.

Advanced project

As of a December 2019 resource estimate, Marimaca hosts 420,000 tonnes of copper in the measured and indicated categories in 704 million tonnes of material grading 0.6% copper. It also has an inferred resource holding 225,000 tonnes of copper within 43 million tonnes grading 0.52% copper.

Sergio Rivera, Marimaca’s VP of exploration, made the initial discovery in 2017. His hunch that this area could host significant mineralization was confirmed only a few months later when a one-in-a hundred-year rainfall washed the Atacama dust away to reveal the green-coloured mountainside at Marimaca.

The company has made three more discoveries on the district-scale land package. They entail Cindy, Mercedes and Roble, which are just three of many other regional targets that could potentially become, with more drilling, satellite deposits to the initial Marimaca development.

A view towards the Marimaca Oxide Deposit. Photo by Henry Lazenby.

In August 2020, the company released a preliminary economic assessment (PEA) for Marimaca , which confirmed its potential to be a low capital cost, high-margin copper mine. Locke points out that it is significantly aided by its location with easy access to infrastructure, including power, transport and water, as well as a highly skilled local workforce and simple logistics.

According to the PEA, Marimaca has a low capital intensity at US$285 million. Operating costs also fall in the bottom 15% of the all-in sustaining cost curve at US$1.29 per lb. over the mine life, which provides a cash margin of 65% at US$3.70 copper.

Locke also notes the project is further advanced than a typical PEA-level asset, with five rounds of metallurgical testing pointing towards recoveries of 76%.

The study outlined a 12-year mine life with strong potential for extension.

On average, it would produce 40,000 tonnes of copper cathode per year via a solvent-extraction electrowinning process. Locke notes that the operation would aim to reduce environmental impacts such as water, opting to use seawater for the process while potentially making use of the project’s ample solar exposure for renewable energy.

Passion for rocks

The Marimaca mineralization differs from other established mines in the region. It entails an easier-to-process iron oxide copper-gold (IOCG) deposit instead of the more common manto or porphyry-style of mineralization. The company also undertakes a district-scale exploration program to evaluate whether the project is part of a larger emerging copper district.

The company believes this is a crucial differentiator for the project.

Paola Kovacic, Marimaca’s exploration manager, showed us around the Marimaca project site, pointing out readily identifiable structural controls in the geology of the three styles of mineralization described there to date. She explained that the deposit appears to be a new style and does not readily conform to any of the major published geological models.

The deposit occurs in a district with several vein-style IOCG deposits, which have common features including regional metamorphism/metasomatism, calcium-sodium alteration, magnetite and hematite, chalcopyrite as the primary copper-bearing mineral, and overall low sulphide content.

“The Marimaca deposit setting includes some of these elements. However, Marimaca also has affinities with ‘manto-type’ mineralization styles, although the monzodiorite mineralization host is unusual since the known manto-type deposits are typically associated with volcanic piles,” Kovacic explained.

“If the host rock issue is not considered, Marimaca is analogous to manto-type copper deposits such as Mantos Blancos or El Soldado. The critical role of structures, dykes, and alteration zoning is common in these deposits. The deep and extensive development of supergene alteration and oxidation is similar to that seen at Mantos Blancos,” she said.

Paola Kovacic, Marimaca’s exploration manager, performs a nail test on high-grade black oxide. Photo by Henry Lazenby.

The Marimaca deposit consists of a supergene copper blanket (oxides and enriched sulphides). The oxide zone is exposed on the surface and has dimensions of about 1.4 km in length, 400 to 600 metres in width, and a thickness range from 150 to 350 metres. The shape of the oxide zone is controlled by the parallel fracture system and dykes, with the deeper zones of oxidation typically related to northwest-trending faults.

However, the rhyodacitic dykes also have a role in the location of higher copper grade zones, in combination with feeders and veins, explains Kovacic. Most copper oxides occur as fracture staining and infill within fracture veins and veinlets.

Creating value

Meanwhile, Marimaca is advancing several multidisciplinary technical workstreams supporting the feasibility study. These initiatives will also form the basis for project permitting and are expected to be finalized before feasibility-level engineering starts. The company expects to start permitting submissions early in 2023.

Locke explained that Marimaca Copper had approached several utility companies in the Mejillones area, which are offering to build, maintain and operate a pipeline from their seawater intake to the Marimaca leaching facility and sell the water to the project at the plant site. The PEA contemplates the installation of a 6 km-long pipeline extending from an existing third-party seawater pipeline and would discharge into the main water reservoir at Marimaca.

In June, Marimaca announced the results of the fifth phase of metallurgical testing, representing the most comprehensive metallurgical study completed to date for the Marimaca oxide deposit (MOD). It is the final phase expected before the planned start of the definitive feasibility study.

“The Phase 5 program is an important de-risking event for Marimaca and confirms the results from the previous four phases of metallurgical testing, which indicate good leach kinetics and moderate acid consumption,” said Locke.

Most recently, Marimaca reported that its ongoing exploration efforts were paying off, with infill drilling demonstrating the excellent thickness and continuity of the mineralized column at the MOD.

Drilling results from the 2022 infill and extensional drilling campaign intersected broad zones of near-surface green copper oxide mineralization in 19 of the 20 drill holes. Drilling was focused on infilling the higher-grade central core of the MOD, and the MAMIX depth-extension zone discovered in the 2021 drilling campaign.

Canaccord Genuity Capital Markets analyst Dalton Baretto said in a July research note the drilling continued to improve confidence in the high-grade central core of the MOD, including additional new extensions at depth below the existing PEA pit limits.

Historical artisanal workings on high-grade portions of the Marimaca deposit. Credit: Henry Lazenby.

Drilling completed up to late June 2022 will inform the planned updated mineral resource estimate for late in the third quarter. The balance of infill drilling is expected to be included for a subsequent resource update.

The analyst expects all budgeted MAMIX extensional drilling to have been completed before the data cut-off, and the work is anticipated to be captured in the planned upcoming resource update. More drill results are expected to be released as assays are returned from the laboratory.

Among the recent highlights were MOD infill holes MAR-156 and ATR-112, which confirmed the higher-grade green oxide zones in the core of the MOD.

Hole ATR-112 returned 118 metres of 0.96% copper from 4 metres, including 56 metres of 1.85% copper. Hole MAR-156 returned 230 metres of 0.53% copper from the surface, including 102 metres of 0.85% copper.

Hole AR-155 returned 72 metres of 0.35% copper from 6 metres, including 26 metres of 0.82% copper.

Infill drilling at the MAMIX deposit returned highlights such as MAR-68 EXT and MAR-23 EXT, demonstrating the continuity of higher grades at depth into the MAMIX zone.

Hole MAR-68 EXT returned 384 metres at 0.64% copper, and MAR-23 EXT intersected 96 metres at 0.71% copper from 354 metres; and 58 metres at 1.07% copper from 392 metres to the bottom of the hole, within a broader intersection of 436 metres at 0.38% copper from 14 metres.

The higher grade, green oxide core is located at the surface and continues into the MAMIX zone to depths of up to 462 metres – the deepest drilled at the MOD to date. Locke says the near-surface, higher-grade green oxide zones are accessible in the early years of the PEA mine plan, with the 2022 infill drilling program targeting conversion of inferred resources to measured and indicated levels.

“In an optimistic, best-case scenario, Marimaca could be in production by around 2025. The upcoming resource update will probably be the catalyst that demonstrates we’ve got critical mass at Marimaca, and provide investors with more data to sink their teeth into,” Locke said.

At the same time, the company is assessing its development plans, evaluating permitting risks, completing baseline studies and speaking with water and energy suppliers.

“The development plan will be used to identify key engineering required to prepare and potentially file the environmental permit applications with the Chilean authorities. The company has begun preliminary engineering studies, such as hydrogeology, hydrology, geotechnical evaluations, and additional environmental baseline studies covering the project areas.”

Locke notes that when Scope 3 emissions (transportation and smelting) are included, the MOD’s carbon intensity per tonne of refined copper is expected to be in the lowest 10% of all copper projects globally.

“Given that MOD demonstrates high scarcity value in the context of ‘green copper’, given that SX-EW accounts for only about 16% of the world’s primary copper supply, you can see Marimaca is positioned as a leader when it comes to carbon-intensity targets,” he says.

At $3.08, Marimaca shares are trading about 25% cheaper than a year ago, giving the company a market capitalization of $271.4 million. TNM

Be the first to comment on "Site visit: Marimaca Copper increasingly resource-confident on Chile oxide prospect"