These are exciting times for Canadian explorer and developer G2 Goldfields (TSXV: GTWO;US-OTC: GUYGF) says Dan Noone, the company’s chief executive, as it advances the Oko-Aremu gold project in Guyana.

“In less than two-and-half years, we’ve progressed from discovery to our first resource on the project, and this marks a major milestone in unlocking the full value of a project that has the potential to become a district-scale mining operation,” Noone says.

In April, the Toronto-headquartered junior released its first mineral resource estimate for the Oko Main zone on the property.

The resource stands at 793,000 indicated tonnes grading 8.63 grams gold per tonne for 220,000 contained oz. of gold and inferred resources of 3.3 million tonnes grading 9.25 grams gold per tonne for 974,000 gold ounces.

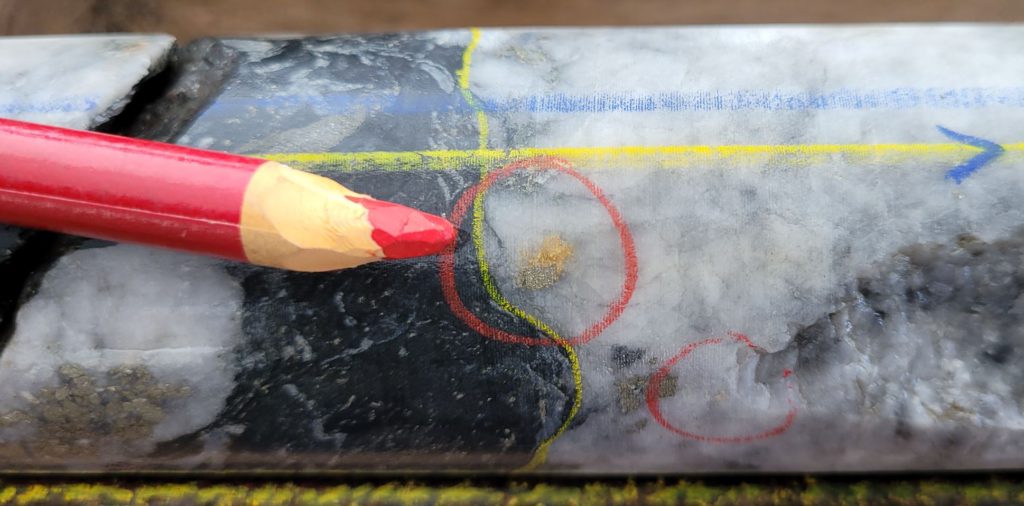

Drillhole OKD-115 returning 4.2m grading 37.2 grams gold per tonne from 421.3 metres downhole at Shear 5. G2 GOLDFIELDS

Noone says the underground resource was estimated using 1,155 composites 1 metre in length that were selected from 98 intersecting diamond drill holes, and comprises mineralization hosted by three primary sub-parallel shear zones (S3, S4, and S5) that extend from 350-900 metres in length.

“Presently, these shear zones have been explored to a depth of approximately 350 metres, with the bulk of the resources contained in S3 and S5. Both S4 and S5 remain open along strike to the north, and all the shears are open down plunge,” he explained.

He says that Oko Main “shows considerable visible gold in core samples, with bulk leach extractable gold testing averaging 98.4% gold recoveries. So, we believe that we’re in the right geological setting to add considerable ounces to the current estimate, and plan to release an updated resource by the end of the year or early into 2023.”

The 111.7-sq.-km Oko-Aremu property covers approximately 17 km of highly prospective strike length along the Oko-Aremu trend on the northern Guyana greenstone belt, about 120 km west of Guyana’s capital, Georgetown.

The region is considered one of the world’s most underexplored and prospective for large-scale

gold discoveries and hosts several gold deposits and discoveries. These include Reunion Gold’s

(TSX: RGD) Oko West, which lies directly south of Oko-Aremu; Toroparu, approximately 90 km to the west, owned by American mid-tier miner GCM Mining (TSX: GCM; US-OTC: TPRFF); Omai Gold Mines’ (TSXV: OMG) Omai, 100 km southeast; and Karouni, about 100 km south, owned by Australian miner Troy Resources (ASX: TRY).

G2 also holds 92.6 sq. km of claims in the Puruni district, approximately 38 km to southwest of Oko-Aremu, which hosts the past-producing Peters mine and the Jubilee mine, an open pit operation currently being worked by “medium-scale” miners.

Guyana’s first producing gold mine, Peters produced 41,915 oz. of gold from 1905 to 1910. Aremu produced 6,488 oz. of gold at an ore grade of 15.6 grams gold per tonne between 1906 and 1911. Although Jubilee contains a vertical shaft sunk in 1907, there is no evidence of past production from the mine.

Noone, who has more than 30 years of international mineral exploration and development experience, managing projects in Guyana, Papua New Guinea, Indonesia, Peru, Ecuador, and Argentina, says the company now intends “to build upon the initial resource estimate for Oko Main, increasing the size and upgrading the inferred resources to the indicated category.”

He says the current resource “only includes drill results from one of several brownfields and grassroots targets so far identified across the district, with ongoing drilling expected to increase the resource estimate significantly.”

Oko Main, he noted, is an orogenic-type gold deposit hosted in carbonaceous sediments. Like the Aurora gold mine, which China’s Zijin Mining acquired from Guyana Goldfields (TSX: GUY) in 2020, the Oko Main deposit is located on the margin of the Cuyuni Basin and shows “potential for significant mineralization at depth,” he says.

Oko Main zone high-grade corridor looking south. G2 GOLDFIELDS

G2’s founders, Noone noted, were involved in the discovery, financing and development of Aurora. “Our executive chairman Patrick Sheridan was the founder and CEO of Guyana Goldfields who sank the discovery hole in 2004. We then took it to feasibility and built the mine in 2015.”

He added that the Guyanese government has always been very supportive of mining. “When we built the Aurora gold mine with Guyana Goldfields, government ministers were always available to meet with our major shareholders, lenders, and engineering contractors.”

G2’s relationship with the government and the Guyana Geology and Mines Commission, he says, has “carried over from the strong relationship we had when we ran Guyana Goldfields.”

Noone says the company’s next round of drilling will target the down-plunge extensions of shear zones 3, 4, and 5 at Oko Main to depths of 700-800 metres to expand and upgrade the high-grade mineralization discovered at the zone.

“In parallel with this, we have also started a district-wide exploration program designed to generate drill targets within the seven priority target areas along the 17-km-long Oko-Aremu trend. Each target area has the potential to host gold mineralization similar in size and grade to Oko Main. Around 10-20% of the drilling this year will focus on targets outside

Oko Main.”

He says the company is also conducting a geophysical survey to identify additional drill targets and has three diamond drill rigs operating on the property.

G2 also plans to conduct a six-hole drill program at Peters, which Noone says is designed to test a southwest-plunging shoot containing high-grade flat lodes down to 500 metres, support an upgraded geological and mineralization model, develop a district-scale mineralization model, and generate additional drill targets.

Songela crew operating drill rig for hole OKD-112. G2 GOLDFIELDS

The company also plans to start an initial six-hole initial drill program at Jubilee to target a high-grade vein system at the Jubilee shaft area, where historical exploration returned vein material up to 23 grams gold per tonne.

To date, G2 has completed 141 drill holes totalling 34,090 metres on the property, with most of the drilling at Oko Main.

Highlights from the drilling include hole OKD-103, which intercepted S3 at a depth of 396 metres and returned 14.3 metres grading 8.2 grams gold per tonne from 433 metres downhole.

Hole OKD-106, which cut 15.5 metres grading 8.5 grams gold from 133.5 metres, extended high-grade gold mineralization in S5; and OKD-109, which intersected three significant intercepts within a 105-metre core length across S3, S4, and S5, returned 7.3 metres grading 7 grams gold from 108.2 metres, 5.6 metres of 8.9 grams gold from 197.4 metres, and 9.5 metres of 14.6 grams gold from 252 metres.

The company also completed an 11-hole, 1,246-metre first pass reconnaissance drill program on Oko North-West, approximately 4 km northwest of Oko Main. Noone says the zone shows the same type of mineralization at Oko Main. The drilling tested multiple target areas along 500 metres of strike length. Assays are pending.

“We also completed three drill holes targeting the Shepherd Vein on the western extent of the four-kilometre-long Aremu vein system,” says Noone, adding that the historic Aremu mine lies at the eastern extension of this system.

G2 first started exploring the property in February 2019, completing a surface sampling program comprising 2,081 soil samples, 164 grab samples, and 674 channel samples.

Grab samples from the program returned gold levels ranging from 1.2-93.8 grams gold per tonne and channel samples 0.8-9.2 grams gold per tonne. Then, the company completed a 10-hole (1,520 metres) follow-up diamond drill program.

“Our initial exploration of the property identified three areas of interest — Aremu North, which includes the Aremu mine, Aremu South, and the Oko Crusher Hill area,” says Noone.

Highlights from the drilling included the discovery hole, OKD-1, which intersected 27 metres grading 5.22 grams gold per tonne from 63 metres downhole, including a higher-grade intercept of 6 metres at 15.8 grams gold.

Hole OKD-9, drilled approximately 300 metres north of OKD-1, returned 10.5 metres grading 1.9 grams

gold from 49.5 metres, including 2.3 metres at 7.8 grams gold; and OKD-5, drilled 250 metres to the south of OKD-1, cut 31.5 metres grading 2.9 grams gold from 40.5 metres, including 8.2 metres at 9.1 grams gold.

G2 acquired the property in October 2019 through the acquisition of Bartica Investments Inc. Bartica held a suite of mineral exploration properties, including the Peters and Aremu mines and the Oko properties.

Noone says that by the end of the year, the company aims “to enlarge the resource area by drilling down to twice the current depth and find another Oko Main deposit among the other seven targets within the district, with the plan to develop Oko-Aremu into a tier-one asset.”

In the longer term, and as Guyana increasingly opens up to mid-and top-tier miners, he says G2 will seek an appropriate producer to take Oko-Aremu to production rather than building the mine, as the company did with Aurora, and expects the project “to provide considerable value to our shareholders.”

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by

G2 GOLDFIELDS and produced in cooperation with The Northern Miner. Visit www.g2goldfields.com for more information.

Be the first to comment on "JV Article: G2 Goldfields releases first resource estimate for its high-grade Oko-Aremu gold project in Guyana"