SolGold (TSX: SOLG; LSE: SOLG) announced it will delay the release of the prefeasibility study for its flagship Cascabel copper-gold project in Ecuador.

The mining company said the delay will allow it to confirm various assumptions affecting the study, such as whether upside options should be incorporated.

It would also allow incoming CEO Darryl Cuzzubbo to settle into his position, SolGold said.

The company said it would provide an update on when the PFS is expected to be completed at its annual general meeting on December 15.

It also said it inked an agreement last week with the government of Ecuador committing to invest a total of US$430 million on exploration at Cascabel over the ten years between 2013 and 2023.

SolGold’s acting chief financial officer, Ingo Hofmaier, said on November 23 the pact provided the company’s shareholders increased protection of their investment in Ecuador.

The world largest miner BHP (NYSE: BHP; LSE: BHP; ASX: BHP) owns 13.5% of the company, and the prospects of a takeover are likely to increase once SolGold’s long-delayed prefeasibility study is complete, some analysts say.

Sixth-largest copper mine

According to Ecuador’s Energy Ministry in 2019. the project “could become the largest underground silver mine [and] third-largest gold and sixth-largest copper in the world.”

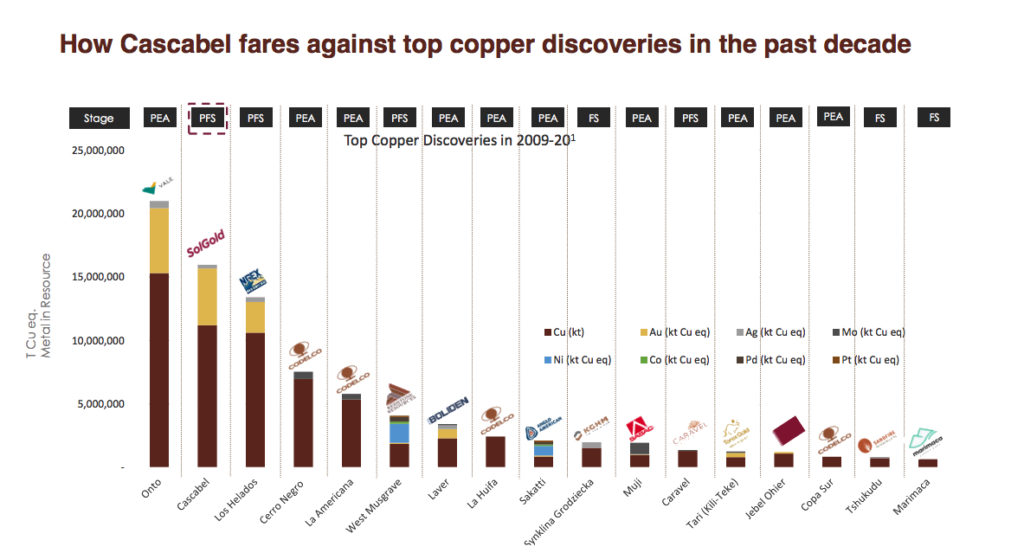

Alpala, the largest deposit found at the Cascabel concession so far, has measured and indicated resources of 2.7 billion tonnes grading 0.37% copper, 0.25 gram gold per tonne and 1.08 parts per million silver (0.53% copper-equivalent) for 9.9 million tonnes of contained copper, 21.7 million oz. gold and 92.2 million oz. of silver.

Once developed, Cascabel is expected to produce an average of 150,000 tonnes of copper, 245,000 ounces of gold and 913,000 ounces of silver in concentrate per year during its 55-year life-of-mine.

Over the first 25 years of mining, the average annual production is expected to be 207,000 tonnes of copper, 438,000 ounces of gold and 1.4 million ounces of silver.

BHP has reportedly been pushing to put SolGold’s entire board up for re-election at the AGM, which is scheduled in December.

Chairman Liam Twigger recently proposed that in order to maintain stability at the company, only three of the directors who did not stand for re-election last year, and the company’s new CEO, would face a vote at the shareholder meeting. The six other board members, including Mather, who were re-elected last year would not.

Ecuador has gained ground as a mining investment destination over the past two years, but opposition to the extraction of the country’s resources could thwart the government’s plan to attract US$3.7 billion in mining investments by next year.

Last year, mining in Ecuador generated US$810 million in exports, US$430 million in taxes and US$374 million in foreign direct investment.

Be the first to comment on "SolGold delays prefeasibility study for Cascabel again"