Clean TeQ’s (TSX: CLQ; US-OTC: CTEQF) Sunrise nickel, cobalt and scandium project in Australia is one step closer to becoming a significant producer of nickel and cobalt sulphate for the lithium-ion battery market.

A definitive feasibility study modelling the first 25 years of production confirmed over US$14 billion in life-of-mine revenues; US$344-million annual earnings before interest, taxes, amortization and depreciation (EBITDA), peaking at US$550 million in years when the operation runs at maximum production rates; a nearly US$1.4-billion after-tax, net present value at an 8% discount rate; and a 19% post-tax, internal rate of return.

The permitted project, 370 km west of Sydney, is one of the largest, undeveloped cobalt projects outside of Africa, and has enough reserves of all three metals to last beyond 40 years.

Initial life-of-mine production could total 450,871 tonnes nickel, 84,007 tonnes cobalt and 250 tonnes scandium oxide.

“Unlike many projects in the market today, this project is shovel-ready and has the benefit of almost 20 years of drilling, evaluation, piloting studies and permitting,” Sam Riggall, Clean TeQ CEO, said during a conference call. “It is not an easy process to prep many projects of this scale in today’s market.”

Not only are the outcomes in the study compelling, Riggall said, but they demonstrate a project that can generate significant volumes of cobalt and nickel sulphate — as well as scandium — from a secure and established mining jurisdiction.

For automotive and consumer electronics customers, he noted, Sunrise is the “largest political-risk insurance policy available in the market today, particularly for users of cobalt,” as supply from the Democratic Republic of the Congo is “increasingly problematic, both from a regulatory and cost perspective.”

The Sunrise project benefits from significant cobalt grades, and, according to the study, will have a C1 cash position of negative US$1.46 per lb. nickel (net of by-product credits from cobalt, scandium and ammonium sulphate) and US$4.68 per lb. nickel before credits.

The study uses commodity prices based on long-term, analyst consensus forecasts, which in the case of nickel was a flat US$7 per lb., plus a US$1 per lb. sulphate premium.

Over the past year, the quoted premium for nickel sulphate has averaged US$1.62 per lb. nickel. For cobalt sulphate, the study assumes a long-term, flat US$30 per lb. cobalt price with no premium, while for scandium oxide it assumes US$1,500 per kilogram.

The study estimates the capital expense to build the US$1.49 billion, including a US$165-million contingency.

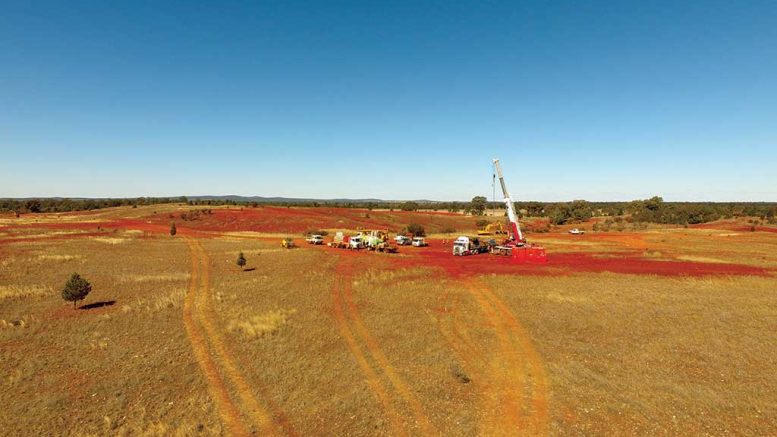

A drill rig at CleanTeq Holdings’ Syerston cobalt-nickel-scandium project in Australia’s New South Wales. Credit: CleanTeq Holdings.

This exceeds the capital expense of US$680 million (A$906 million) — including a US$62-million contingency — estimated in a 2016 prefeasibility study.

The higher cost in the latest study owes primarily to changes of scope for delivering more revenue, EBITDA and return on capital, such as a larger refinery to boost metal production, and revising the mine plan to bring forward cobalt metal production.

An investment decision on the laterite project is expected early next year and construction could start shortly thereafter.

The company estimates it will take 24 months to build and another 24 months to ramp up to full production.

The project is forecast to be cash-flow positive in 2022 and make cumulative free cash flows of US$5 billion over the initial 25-year mine life.

During the 10 years following the first year of ramp-up, the project is forecast to produce an annual 19,600 tonnes per year of nickel in sulphate form and 4,400 tonnes of cobalt in sulphate form. Life-of-mine revenue from nickel sulphate is an estimated US$7.8 billion (or 56.5% of total revenue), and US$5.6 billion from cobalt sulphate (or 39.5% of total revenue).

The company would use proprietary, continuous resin-in-pulp technology to process the ore and produce nickel and cobalt sulphate for battery-cathode production.

The scandium would be used in lightweight aluminum alloys for transportation markets.

The mine would produce an average 95 tonnes a year of scandium oxide. But the financial model in the study assumes only 10 tonnes a year would be refined into high-purity scandium oxide and sold to end users.

The company is working with its partners Universal Alloy Corp., Chinalco and Airbus Group to develop lightweight aluminum-scandium alloys for the aerospace and automotive sectors.

“This is the right project for this moment in time,” Riggall said. “It’s strongly leveraged to the battery-driven revolution that is changing the way the world approaches sustainability in key industries of transport, energy storage and power supply.”

According to Clean TeQ, global passenger plug-in electric vehicle (EV) sales year-to-date were 418,000 units — up 66% year-on-year. EV lithium-ion battery sales from January to April reached 23.3 gigawatt hours, which is up 60% from the same period a year ago.

Riggall noted that with the feasibility study completed, the company can now work to line up offtake agreements and project financing. So far, 20% of Sunrise’s future production has been committed to offtakers.

He added the feasibility study has “confirmed that the Sunrise project is a highly economic, sustainable and globally significant resource development. It’s ideally placed to provide the critical raw material the world needs to expand the global EV fleet.

“The market for a product like this is very good, there are a number of companies that are significantly engaged with us already, and many of them were waiting for the definitive feasibility study to be released.”

The company already has a banking syndicate that includes International Commercial Bank of China, National Australia Bank, Natixis and Société Générale, which Riggall said is “standing by to commence work in earnest on a debt-finance facility.”

Current proven and probable reserves measure 147.4 million tonnes grading 0.56% nickel and 0.09% cobalt, and 53 parts per million scandium.

On news of the feasibility study’s release, Clean TeQ’s shares closed at 90¢, down 12%, within a 52-week trading range of 87¢ to $2.10.

With 590.5 million shares outstanding, the company has a $531-million market capitalization.

Be the first to comment on "Study shows Clean TeQ’s Sunrise is world-class"