After taking control of the Ekati diamond mine in the Northwest Territories earlier this year, Dominion Diamond (TSX: DDC; NYSE: DDC) is working to extend the life of Canada’s first diamond mine.

Dominion has applied for a land use permit and a Class A water licence to extend the Ekati mine to include three kimberlites — Lynx, Jay and Cardinal.

Bringing new kimberlites into the mine plan would extend the mine life at Ekati beyond late 2019, when mining would end under the current plan. Production at Ekati began in 1998.

The Lynx kimberlite, located about 3 km southwest of the Misery pit, has indicated resources of 1.3 million tonnes grading 0.8 carat per tonne and inferred resources of 100,000 tonnes at the same grade. In late 2012, modelled prices for Lynx diamonds were US$257 per carat.

The Jay and Cardinal kimberlites, located about 7 km northeast of Misery, could have a more significant impact on Ekati’s mine life — adding between 10 to 20 years of operation.

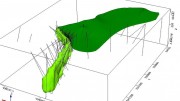

The Jay kimberlite contains indicated resources of 36.2 million tonnes grading 2.2 carats per tonne for 78 million carats, plus 9.5 million tonnes of inferred resources averaging 1.4 carats for 13 million carats. Dominion estimates the value of Jay diamonds at US$74 per carat.

While the Lynx kimberlite is located in the Core area of Ekati, which is 80% owned by Dominion, Jay and Cardinal are located in the Buffer zone area, where Dominion holds a 58.8% interest.

A prefeasibility study on Jay and Cardinal, which Dominion estimates could begin production in 2019, are under way.

BMO Research estimates that Jay would cost $1 billion to develop.

Dominion also owns 40% of the nearby Diavik mine with majority partner Rio Tinto (RIO-N). It completed the acquisition of BHP Billiton’s 80% interest in Ekati for US$553 million in April.

Diavik is expected to produce 7.3 million carats on a 100% basis this year, while in October, Ekati had already produced more than 1 million carats since Dominion took over operations in April.

BMO Capital Markets mining analyst Ed Sterck has an “outperform” rating on Dominion, with a target price of $20.

In late October, the stock traded at $14.14 in a 52-week trading range of $12.31-$17.43. The company has 85 million shares outstanding.

Be the first to comment on "Dominion looks to add life to Ekati"