Avino is an old name in Mexican mining for a couple of reasons. Most prominently, it is the name of a legendary silver and copper vein 1.6 km long and 182 metres wide at the surface. The vein’s scale helped make it the first mine in the Sierra Madre. It went into production in 1558, and didn’t stop hosting production in one form or the other until the Mexican Revolution in 1912.

Avino is also the name of a company with decades of history at the site. Avino Silver & Gold Mines (ASM-V, ASM-X) first arrived on the scene in 1968, and while it built and operated a mine there for 27 years, mining came to a halt at the site in 2001.

But a recent deal with a private Mexican company that has long held the rights to mining the Avino vein has the Vancouver-based junior returning to the property full circle.

Avino shut down underground mining at the silver- and copper-rich Avino vein when low metal prices and a nearby smelter closure conspired to crunch its profit margins. But at the time of the shutdown a portion of the vein — lying in the Elena Tolosa (ET) zone — still had silver, copper and gold to give.

In its final year of production the zone turned out 860,000 oz. silver, 3.5 million lbs. copper and 6,500 oz. gold. And it still had non-compliant resources of 1.5 million tonnes grading 100 grams silver, 0.92 gram gold and 0.63% copper.

But an agreement with privately held Mexican firm Minerales de Avino positions the company to clean up unfinished business.

The new agreement gives Avino the right to explore and mine the ET zone for 15 years, with an option to extend the agreement for another five years. For that right Avino will issue 135,189 common shares to Minerales and grant it a 3.5% net smelter return.

Once the transaction is done Avino has two years to develop the mining facilities — a time restriction that David Wolfin, Avino’s president and chief executive, says the company will have no problem meeting.

Wolfin says it will cost less than $1 million to make the remaining modifications to the mill so that it can process ore from the historic mine at ET and from the newer San Gonzalo deposit, which sits 2 km away from the original Avino mine.

“We’ve been mining stockpiles left over from the old mine, and in July we’ll switch back to mining San Gonzalo with commercial production from that deposit coming in the last quarter of this year,” Wolfin explains. The company currently has $5 million in the bank.

While it is mining San Gonzalo — which differs from the Avino vein because it holds narrow veins of higher-grade mineralization — it will be proving up a compliant resource at ET and de-watering the old mine there.

When ore is ready to be pulled out of the ground in the ET zone it will run through the original mill, which has been refurnished with two lines. The plan is to process ore from ET along one line at a rate pf 1,000 tonnes per day, while ore from San Gonzalo is processed along the second line at 250 tonnes per day.

Wolfin says the company has enough faith in a bulk-sample result from San Gonzalo — which showed 76% silver recoveries at production cash costs of US$7.22 per oz. — to forego a feasibility study on the deposit.

Drilling in 2008 compiled an inferred resource at the zone and the 42-hole, 9,204-metre drill program outlined 444,250 tonnes grading 332 grams silver and 2.61 grams gold for 4.75 million oz. silver and 37,300 oz. gold.

Drilling also returned a highlight intercept of 3,908 grams silver and 13.71 grams gold over 1 metre.

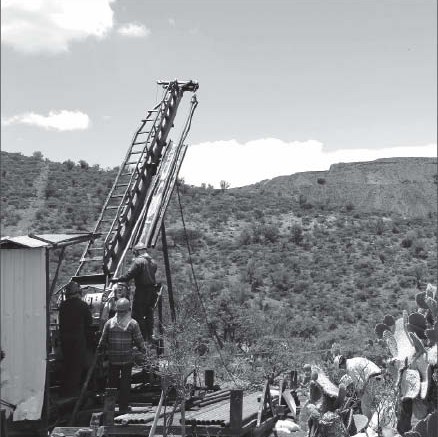

The company is getting a better handle on the Avino vein at ET through a 10-hole, 4,000-metre drill program that will be part of the zone’s new National Instrument 43-101 resource estimate.

The Avino mine is located in north-central Mexico’s Durango region, 80 km northeast of the city of Durango in the heart of the Sierra Madre silver belt.

The property covers 13.2 sq km., has access to water and grid power and is easily accessible by road.

The historic mine produced 16 million oz. silver, 96,000 oz. gold and 24 million lbs. copper over its 27-year life.

On Feb. 28 — the day news of the agreement with Minerales was released — Avino shares were up 17%, or 32¢, to $2.17 on 102,000 shares traded.

Be the first to comment on "Avino inches closer to production"